Credit Saint and Lexington Law are two prominent companies in the credit repair industry, each offering services to help individuals improve their credit scores through the correction of inaccuracies in their credit reports. While both companies share the common goal of aiding consumers in enhancing their financial standing, they distinguish themselves through their specific service offerings, pricing structures, and unique features.

Features

Credit Saint stands out for its transparent and aggressive approach to credit repair. It offers a variety of packages tailored to different needs, including basic, moderate, and aggressive credit repair options. This allows consumers to choose a plan that matches the severity of their credit report issues. Credit Saint takes pride in offering a personalized analysis and a clear timeline for expected results, providing clients with a detailed understanding of their credit repair process.

One of the key technical features of Credit Saint is its use of a user-friendly online dashboard, which clients can use to track their progress in real-time. The dashboard displays the disputed items and the status of each dispute, making it easy for clients to follow along with the repair process. Credit Saint emphasizes its dedication to customer education by providing extensive resources on credit management and financial health, aiming to equip clients with the knowledge to maintain their improved credit score over time.

Lexington Law brings a strong legal background to the credit repair process. As one of the oldest firms in the industry, it leverages the expertise of attorneys and paralegals in navigating the complexities of credit reporting laws. Lexington Law offers a range of services that go beyond simple dispute letters, including cease and desist letters to debt collectors and other legal interventions when necessary. This legal expertise allows them to challenge inaccuracies on a client’s credit report with a high degree of professionalism and authority.

Technical features that set Lexington Law apart include its advanced technology for tracking and analyzing credit report changes, as well as a sophisticated mobile app that provides clients with easy access to their case status, credit score analysis, and educational content. The firm also distinguishes itself through its proactive approach, not only disputing inaccuracies but also advising clients on ways to positively impact their credit scores through strategic financial behaviors.

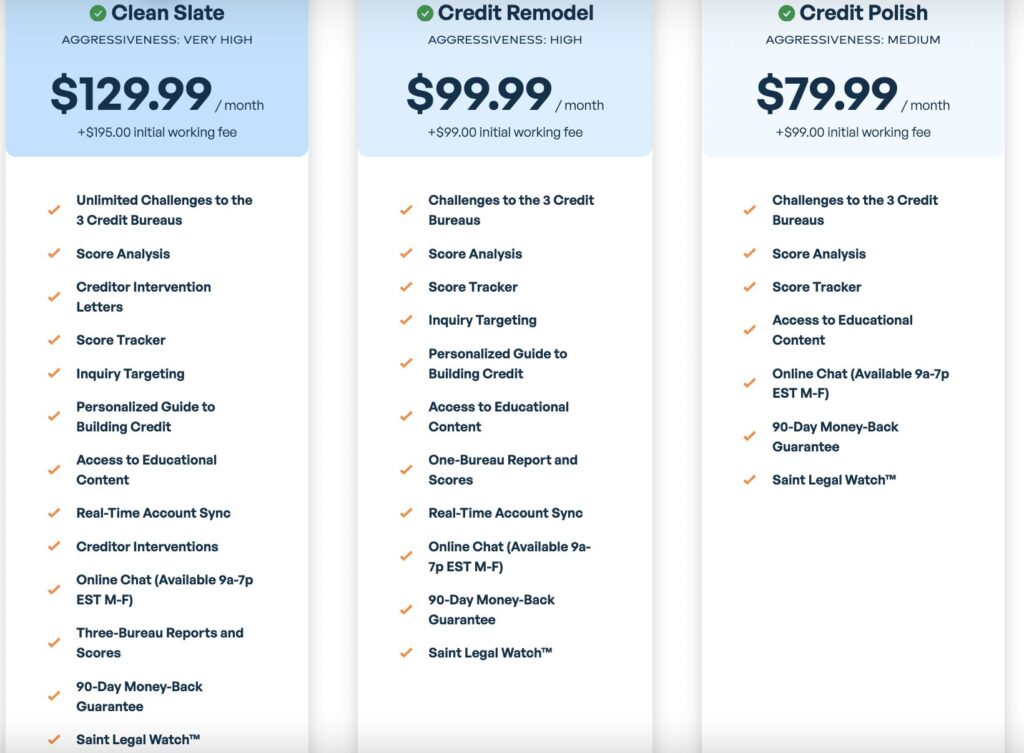

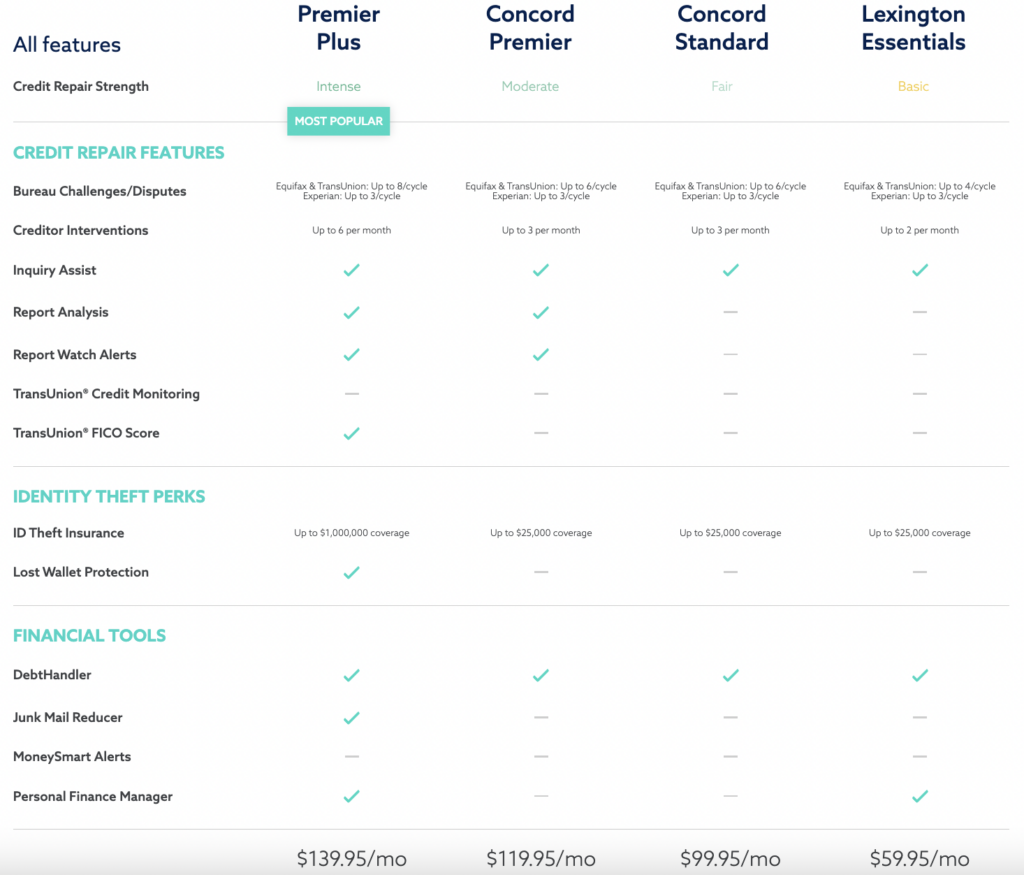

Pricing Plans

Both companies operate on a subscription model, with monthly fees that reflect the level of service provided. Credit Saint is often praised for its clear-cut pricing and the ability to cancel services at any time without incurring additional charges.

Lexington Law, while sometimes criticized for its higher fees, justifies the cost with its comprehensive legal approach and a broader range of services.

Summary

While both Credit Saint and Lexington Law offer effective solutions for individuals looking to repair their credit, the choice between them depends on the customer’s specific needs and preferences. Credit Saint might be more appealing to those who value a highly transparent and educational approach, with the ability to choose a service level that matches their situation. Lexington Law, with its strong legal foundation and comprehensive services, might be better suited for individuals facing complex credit issues that require legal intervention beyond simple disputes. Ultimately, both companies have proven track records in helping consumers achieve better financial health through improved credit scores.

Comparison Table

| Feature | Credit Saint | Lexington Law |

|---|---|---|

| Approach | Transparent and aggressive credit repair with personalized analysis | Legal expertise with attorneys and paralegals to navigate credit laws |

| Service Options | Basic, moderate, and aggressive credit repair packages | Comprehensive services including legal interventions |

| Client Dashboard | User-friendly online dashboard to track progress | Advanced technology and mobile app for case status and credit score analysis |

| Educational Resources | Extensive resources on credit management and financial health | Educational content through the app and website |

| Pricing Structure | Clear-cut pricing with the ability to cancel anytime | Subscription model with monthly fees reflecting comprehensive legal services |

| Unique Features | Real-time tracking of disputed items | Legal letters to debt collectors and advice on financial behaviors |