Tax identity theft is a growing concern for taxpayers across the globe. It occurs when someone uses another person’s social security number to file a fraudulent tax return and obtain a refund. In this article, we will discuss tax identity theft and how you can protect yourself from it.

What is Tax Identity Theft?

Tax identity theft occurs when someone uses another person’s social security number to file a fraudulent tax return and claim a refund. The identity thief typically obtains personal information through a data breach, phishing scam, or by stealing mail. The Internal Revenue Service (IRS) estimates that tax identity theft costs taxpayers billions of dollars each year.

Over 1 Million Tax Returns Were Flagged by the IRS for Potential Identity Theft During Last Tax Season.

How Does Tax Identity Theft Occur?

Tax identity theft typically occurs when a thief uses someone else’s stolen personal information, such as a Social Security number, to file a fraudulent tax return with the Internal Revenue Service (IRS) or state tax agency to claim a refund. Thieves often obtain this information through various means, including phishing scams, hacking into personal or financial accounts, stealing physical documents like W-2 forms from mailboxes or unsecured locations, or purchasing personal data on the dark web.

Employment-related identity theft is another variant, where the thief uses someone else’s Social Security number to gain employment. This can lead to issues with the IRS due to unreported income attributed to the victim’s Social Security number.

Data breaches at organizations that hold personal and financial information also serve as a significant source for thieves to acquire the necessary data to commit tax identity theft. These breaches can expose sensitive information of millions of individuals at once, making them potential targets.

The use of sophisticated malware to infiltrate personal computers and networks is another method. Malware can capture keystrokes and other personal information directly from the users’ devices, which is then used to commit fraud.

Social engineering tactics, where thieves pose as legitimate entities like banks, credit companies, or even the IRS itself, trick individuals into revealing personal information. Victims are often contacted via email, phone, or text messages with requests for sensitive information under the guise of verifying accounts or fixing supposed issues.

Once the thief has obtained the necessary personal information, they can file a tax return in the victim’s name early in the tax season before the legitimate taxpayer files. By providing a false income amount and other details, they aim to maximize the fraudulent refund. The refund is typically directed to a bank account controlled by the thief or onto a prepaid credit card.

The rise of online tax filing has facilitated the ease with which these crimes are committed, allowing fraudsters to submit numerous fraudulent tax returns quickly and with relative anonymity. The IRS and state tax agencies have implemented measures to detect and prevent tax identity theft, but the sheer volume of returns and the sophistication of some fraudulent tactics continue to pose challenges.

How to Detect Tax Identity Theft

Detecting tax identity theft can be challenging, as the thief may have used your personal information to file a fraudulent tax return before you file your legitimate return. However, there are several signs that may indicate that you have been a victim of tax identity theft. Here are some of the common indicators to look out for:

- Receiving a Letter from the IRS – If the IRS detects a suspicious tax return that uses your Social Security number, they will send you a letter requesting additional information or verifying your identity. If you receive a letter from the IRS that you were not expecting, it may be a sign of tax identity theft.

- Unexpected Changes in Refund Amount – If you file your tax return and notice that the refund amount is significantly different from what you expected, it may be a sign that someone else has filed a fraudulent return using your information.

- Receiving Tax Forms from an Unknown Employer – If you receive tax forms, such as a W-2 or 1099, from an employer you don’t recognize, it may be a sign that someone is using your personal information to work and earn income under your name.

- Receiving IRS Notices for Unreported Income – If the IRS sends you a notice about unreported income or taxes owed for a year you did not file a return, it may be a sign that someone else has filed a fraudulent return using your information.

- Errors or Inaccuracies on Your Tax Return – If you notice errors or inaccuracies on your tax return, such as incorrect Social Security numbers, deductions, or income, it may be a sign that someone else has filed a fraudulent return using your information.

One key indicator is receiving a letter from the IRS that more than one tax return was filed using your Social Security number. This suggests someone else has filed a return in your name, attempting to claim a fraudulent refund. Similarly, if the IRS notifies you of unreported income from an employer you don’t recognize, this could mean someone else has used your Social Security number to gain employment, thereby affecting your tax obligations.

Monitoring your credit report is another crucial step. Look for unauthorized accounts or inquiries that you did not initiate. Such activities could indicate that someone is misusing your personal information to open accounts or make purchases, which can also tie back to tax identity theft if they attempt to use your financial accounts to route fraudulent tax refunds.

Engage with the IRS directly if you suspect something is amiss. They have tools and procedures in place for identity verification and can help secure your tax account. For instance, they might issue an Identity Protection PIN (IP PIN), a six-digit number that adds an extra layer of protection by ensuring that only you can file a tax return with your Social Security number.

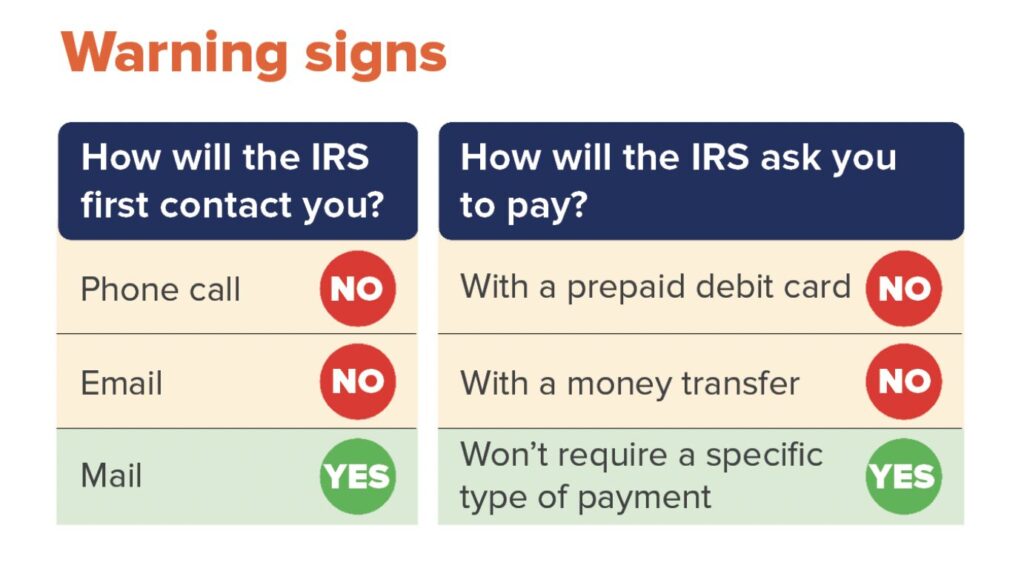

Be wary of phishing attempts, which are fraudulent attempts to obtain sensitive information such as usernames, passwords, and credit card details, often for malicious reasons, by masquerading as a trustworthy entity in an electronic communication. The IRS never initiates contact with taxpayers via email, text messages, or social media channels to request personal or financial information. Recognizing and reporting phishing attempts can prevent tax identity theft.

Regularly update your computer security software to protect against malware and viruses that can steal personal information, including your financial data and Social Security number. Use strong, unique passwords for each of your accounts and consider using a password manager to keep track of them. Secure your personal information, both physical and digital. Shred documents with sensitive information before disposal, and secure your social security card and other important documents in a safe place.

How to Protect Against Tax Identity Theft

To protect yourself against tax identity theft, you should take the following precautions:

- Protect Your Personal Information – The first step to protecting yourself from tax identity theft is to safeguard your personal information. Keep your Social Security number, date of birth, and other sensitive information safe and secure. Don’t carry your Social Security card with you, and don’t give out personal information over the phone or online unless you’re sure of who you’re dealing with.

- File Your Taxes Early – Filing your taxes early can reduce the risk of tax identity theft. If you file your return before a thief can file a false return using your information, you’re less likely to become a victim. Plus, if you’re due a refund, you’ll get it sooner.

- Use a Secure Internet Connection – When you file your taxes online, make sure you’re using a secure internet connection. Don’t file your taxes from a public Wi-Fi hotspot, which can be easily hacked. Use a trusted internet connection, such as your home network, to file your taxes.

- Check Your Credit Report – Regularly checking your credit reports can alert you to any suspicious activity, including tax identity theft. If you see any unauthorized activity on your credit report, report it to the credit reporting agency and the IRS immediately.

- Be Wary of Scams – Tax identity thieves often use scams to obtain personal information. Be wary of phone calls, emails, and texts from people claiming to be from the IRS or other government agencies. The IRS will never call, email, or text you to ask for personal information.

- Use Strong Passwords – Protect your online accounts with strong passwords that are difficult to guess. Avoid using simple passwords such as “1234” or “password.” Instead, use a combination of letters, numbers, and symbols.

- Use Two-Factor Authentication – Two-factor authentication is an additional layer of security that requires you to enter a code or use a biometric authentication method to access your account. Many tax preparation services and financial institutions offer two-factor authentication. Enable it to protect your accounts from unauthorized access.

Begin by safeguarding your Social Security number. Treat it as confidential information and share it only when absolutely necessary. Be skeptical of unsolicited requests for personal information, especially if they claim to be from the IRS or another official body, as these are common tactics in phishing scams.

Use strong, unique passwords for all online accounts, particularly those related to financial transactions or personal information. Consider using a password manager to help manage these passwords securely. Enable two-factor authentication wherever it’s available to add an extra layer of security. This means even if a hacker discovers your password, they still need a second piece of information, like a code sent to your phone, to access your account.

Regularly review your credit reports from the three major credit bureaus. Look for any unfamiliar accounts or inquiries that could indicate fraudulent activity. You’re entitled to one free report per year from each bureau, and monitoring these reports can help you catch signs of identity theft early.

File your tax returns as early as possible. By filing early, you reduce the window of opportunity for a thief to file a fraudulent return in your name. Keep your electronic tax files and any documents with personal information on a secure device. Use trusted tax preparation services and ensure any tax software you use is up-to-date to protect against vulnerabilities.

Be cautious with emails, phone calls, and text messages, especially those that solicit personal information or pressurize you to act quickly. The IRS does not contact taxpayers via email, text, or social media for personal or financial information. Recognize the signs of phishing and report suspicious emails or calls.

Ensure your home network is secure. Use a strong Wi-Fi password and consider using a VPN, especially when conducting financial transactions or sending sensitive information online. Keep your operating system, antivirus, and other software up to date to protect against the latest security threats.

If you move, notify the IRS and the U.S. Postal Service promptly to prevent tax documents from being sent to the wrong address. Additionally, consider using the IRS Identity Protection PIN (IP PIN) program, which provides a unique PIN to eligible taxpayers that must be used to file their tax returns, adding an extra layer of security.

$303,718,702 Worth of Fraudulent Refunds Were Stopped by the IRS During Last Tax Season.

Educate yourself about current tax scams and stay informed about new threats. The IRS regularly updates information on tax-related scams, providing a valuable resource for staying ahead of potential threats.

What to Do If You Become a Victim of Tax Identity Theft?

If you become a victim of tax identity theft, you should take the following steps:

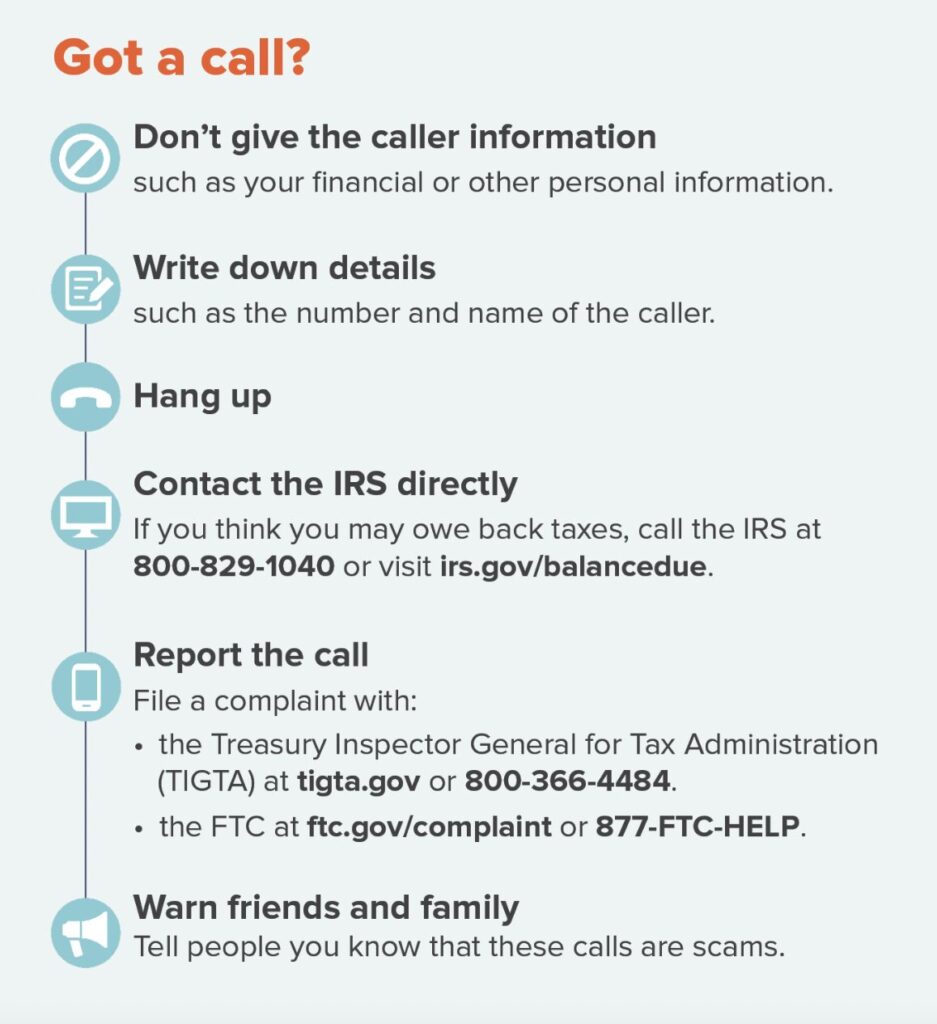

- Contact the IRS – The first step is to contact the IRS immediately. You should call the IRS Identity Protection Specialized Unit (IPSU) at 1-800-908-4490. Explain that you suspect that someone has used your personal information to file a fraudulent tax return, and request an Identity Protection PIN (IP PIN).

- File a Police Report – File a report with your local police department. Make sure to obtain a copy of the report and keep it for your records.

- Review Your Credit Reports – Review your credit reports from all three credit bureaus to see if there are any unauthorized accounts or charges related to your tax identity theft. If you find any errors or fraudulent accounts, report them to the credit bureau and the relevant creditor or lender.

- Report the Theft to the FTC – Report the tax identity theft to the Federal Trade Commission (FTC) by filing a complaint online at IdentityTheft.gov or by calling 1-877-438-4338.

- Contact Your Tax Preparer – If you used a tax preparer to file your tax return, contact them immediately to alert them to the situation. They may be able to help you identify the source of the fraud and take steps to prevent future incidents.

- Consider Placing a Credit Freeze – Consider placing a credit freeze on your credit reports to prevent any further fraudulent activity. This will restrict access to your credit report, making it harder for a thief to open new accounts or lines of credit in your name.

- Stay Vigilant – Keep a close eye on your financial accounts and credit reports for any signs of suspicious activity. Be wary of phishing scams or unsolicited calls or emails asking for personal information.

Act quickly if you suspect or discover that you’ve become a victim of tax identity theft. Contact the IRS immediately to report the fraud. You can do this by calling the number provided on any notice you might have received from the IRS. If you haven’t received a notice but suspect fraud, you can call the IRS Identity Protection Specialized Unit at 800-908-4490. Prepare to verify your identity with them, which may involve providing your previous year’s tax return, your Social Security number, and other personal information.

Complete IRS Form 14039, Identity Theft Affidavit. This form alerts the IRS that your identity has been compromised and that someone may have used your identity to commit tax fraud. You can submit this form electronically or mail it, depending on your specific situation.

Place fraud alerts on your credit reports by contacting one of the three major credit bureaus: Equifax, Experian, or TransUnion. Once you place a fraud alert with one bureau, they are required to inform the other two. This action makes it harder for identity thieves to open more accounts in your name by requiring any new creditor to take steps to verify your identity before issuing credit.

Consider placing a credit freeze on your files. A credit freeze, also known as a security freeze, restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name. Unlike a fraud alert, you must contact each of the three credit bureaus individually to set up a freeze.

Review your credit reports carefully for any transactions or accounts you don’t recognize. If you find anything suspicious, report it to the credit bureau and the creditor involved. This step is crucial in removing fraudulent entries from your credit history.

Change passwords, security questions, and PINs for your online accounts, especially those related to banking and finance. Ensure that you use strong, unique passwords for each account to prevent further unauthorized access.

Continue to monitor your credit reports and financial statements regularly for signs of fraudulent activity. Early detection can help minimize the damage caused by identity theft.

Report the incident to your local police department. Provide them with as much documentation as possible, including any notices from the IRS, copies of your credit reports, the IRS Identity Theft Affidavit, and any other evidence of fraud. This report can help in establishing your credibility when disputing fraudulent charges or accounts.

Contact the Federal Trade Commission (FTC) through IdentityTheft.gov or by calling 1-877-438-4338. The FTC does not resolve individual cases of identity theft, but they can provide valuable resources and assist you in creating a recovery plan.

Report Tax Identity Theft

Report Your Tax ID Theft to the FTC at IdentityTheft.gov

Stay organized throughout the process. Keep a log of all communications, including dates, names, and phone numbers. Store all correspondence and documentation related to the identity theft in a secure location. This organized approach will be beneficial in tracking your case and disputing fraudulent activity.

Bottom Line

In conclusion, tax identity theft is a serious issue that can cause significant financial harm to taxpayers. By taking steps to protect your personal information and monitoring your tax account, you can reduce your risk of becoming a victim of tax identity theft. If you do become a victim, it is important to take immediate action to report the fraud and prevent further harm.

2025 Data Sources

- https://www.irs.gov/newsroom/taxpayer-guide-to-identity-theft

- https://www.irs.gov/identity-theft-central

- https://consumer.ftc.gov/articles/what-know-about-tax-identity-theft

- https://www.justice.gov/tax/stolen-identity-refund-fraud

- https://www.tigta.gov/sites/default/files/

reports/2023-05/202340029fr.pdf