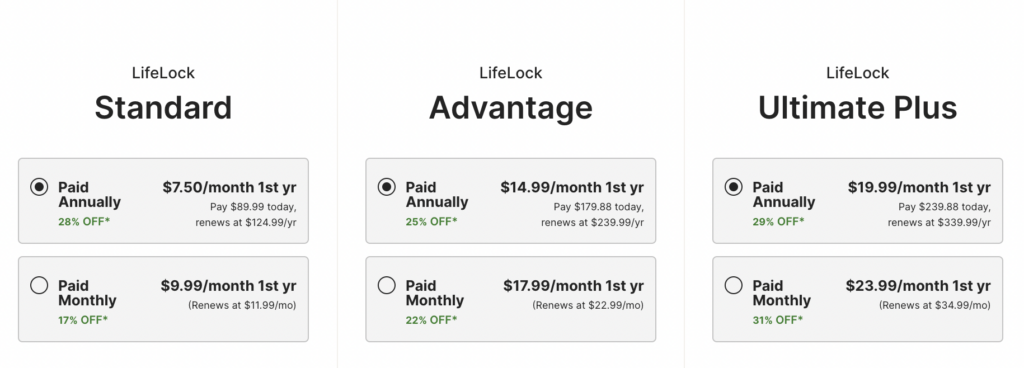

The cost of LifeLock varies depending on the plan and the level of protection you choose. LifeLock offers three different plans: LifeLock Standard, LifeLock Advantage, and LifeLock Ultimate Plus.

- LifeLock Standard: $9.99 per month for the first year ($11.99 per month after that).

- LifeLock Advantage: $17.99 per month for the first year ($22.99 per month after that).

- LifeLock Ultimate Plus: $23.99 per month for the first year ($34.99 per month after that).

You also have the opportunity to pay annually to receive an additional discount:

- LifeLock Standard: $89.99 per year for the first year ($124.99 per year after that).

- LifeLock Advantage: $179.98 per year for the first year ($239.99 per year after that).

- LifeLock Ultimate Plus: $239.98 per year for the first year ($339.98 per year after that).

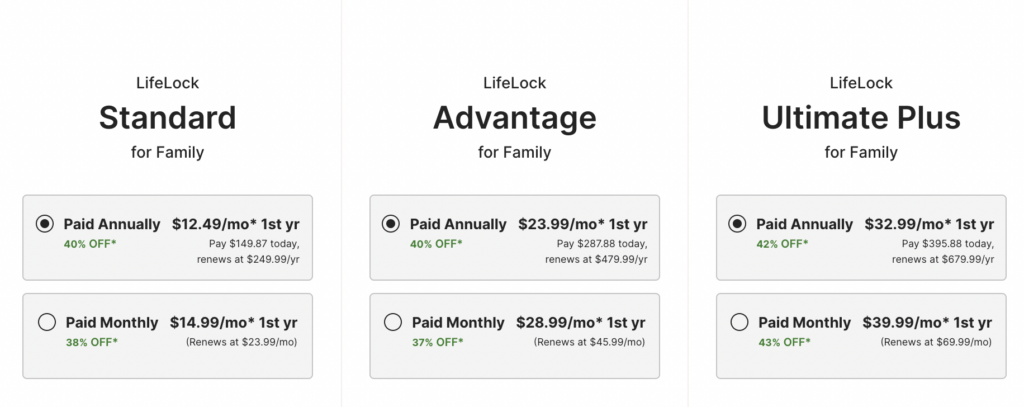

LifeLock Family Plans

LifeLock also offers the same plans in a family format. Pricing varies depending on the size of your family and if you want to protect your children. The following are LifeLock family plans for 2 adults:

- LifeLock Standard: $14.99 per month for the first year ($23.99 per month after that).

- LifeLock Advantage: $28.99 per month for the first year ($45.99 per month after that).

- LifeLock Ultimate Plus: $39.99 per month for the first year ($69.99 per month after that).

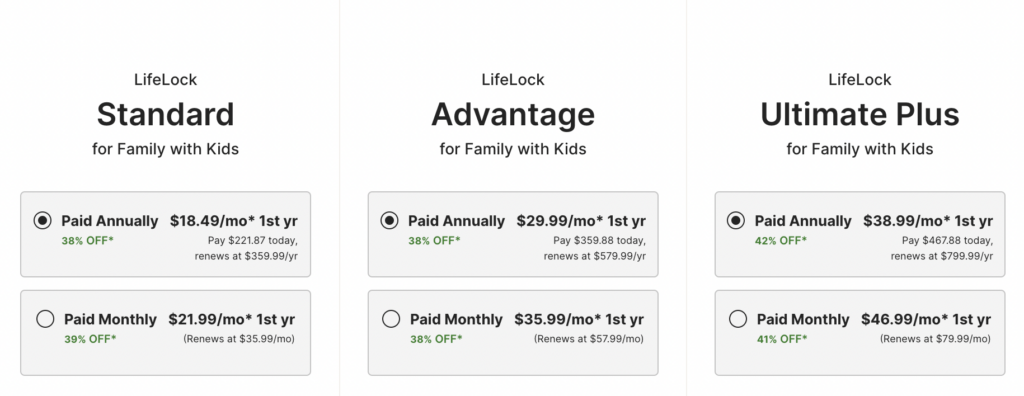

For those with children that want to protect against child identity theft, LifeLock offers the following family plans covering up to two adults and five children:

- LifeLock Standard: $21.99 per month for the first year ($35.99 per month after that).

- LifeLock Advantage: $35.99 per month for the first year ($57.99 per month after that).

- LifeLock Ultimate Plus: $46.99 per month for the first year ($79.99 per month after that).

LifeLock Standard

LifeLock Standard is the entry-level plan offered by LifeLock, which provides basic identity theft protection services. Here are some of the key features of LifeLock Standard:

- Dark web monitoring: LifeLock monitors the dark web for your personal information, such as your Social Security number, name, and address, and alerts you if it is found.

- SSN and credit alerts: LifeLock monitors your Social Security number and sends you an alert if it is used to apply for credit or services, as well as monitoring your credit file for changes.

- Lost wallet protection: LifeLock provides assistance if you lose your wallet, including canceling and replacing credit cards and other identification documents.

- Identity restoration support: If you become a victim of identity theft, LifeLock provides dedicated identity restoration specialists to help you resolve the issue.

- Million dollar protection package: LifeLock offers a $1 million protection package, which includes reimbursement for stolen funds, personal expenses, and legal fees, subject to the terms and conditions of the plan.

It’s important to note that LifeLock Standard does not include some of the advanced features offered by the higher-tier plans, such as credit monitoring from all three major credit bureaus or Norton 360 with LifeLock. If you’re looking for more comprehensive identity theft protection, you may want to consider one of the other LifeLock plans.

LifeLock Advantage

LifeLock Advantage is a mid-tier plan offered by LifeLock, which provides more advanced identity theft protection services than the entry-level LifeLock Standard plan. Here are some of the key features of LifeLock Advantage:

- Dark web monitoring: LifeLock monitors the dark web for your personal information, such as your Social Security number, name, and address, and alerts you if it is found.

- SSN and credit alerts: LifeLock monitors your Social Security number and sends you an alert if it is used to apply for credit or services, as well as monitoring your credit file for changes from all three major credit bureaus.

- Bank account and credit card activity alerts: LifeLock monitors your bank account and credit card activity and sends you an alert if there is any unusual activity, such as large purchases or changes to your account information.

- Investment account activity alerts: LifeLock monitors your investment accounts and sends you an alert if there is any unusual activity, such as trades or transfers.

- Home title monitoring: LifeLock monitors your home title for any fraudulent activity, such as unauthorized changes or liens.

- Identity restoration support: If you become a victim of identity theft, LifeLock provides dedicated identity restoration specialists to help you resolve the issue.

- Million dollar protection package: LifeLock offers a $1 million protection package, which includes reimbursement for stolen funds, personal expenses, and legal fees, subject to the terms and conditions of the plan.

In addition to the above features, LifeLock Advantage also includes Norton 360 with LifeLock, which provides antivirus and malware protection for up to 10 devices, as well as a VPN and SafeCam features to help protect your online privacy.

LifeLock Ultimate Plus

LifeLock Ultimate Plus is the highest-tier plan offered by LifeLock, which provides the most comprehensive identity theft protection services. Here are some of the key features of LifeLock Ultimate Plus:

- Dark web monitoring: LifeLock monitors the dark web for your personal information, such as your Social Security number, name, and address, and alerts you if it is found.

- SSN and credit alerts: LifeLock monitors your Social Security number and sends you an alert if it is used to apply for credit or services, as well as monitoring your credit file for changes from all three major credit bureaus.

- Bank account and credit card activity alerts: LifeLock monitors your bank account and credit card activity and sends you an alert if there is any unusual activity, such as large purchases or changes to your account information.

- Investment account activity alerts: LifeLock monitors your investment accounts and sends you an alert if there is any unusual activity, such as trades or transfers.

- Home title monitoring: LifeLock monitors your home title for any fraudulent activity, such as unauthorized changes or liens.

- Credit monitoring from all three major credit bureaus: LifeLock monitors your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and sends you an alert if there are any changes that could indicate fraud or identity theft.

- Annual credit reports and scores: LifeLock provides annual credit reports and scores from all three major credit bureaus, so you can monitor your credit health.

- Bank and credit card activity alerts for non-personal information: LifeLock monitors your bank and credit card activity for non-personal information, such as changes to your mailing address or contact information.

- Priority access to identity restoration specialists: If you become a victim of identity theft, LifeLock provides priority access to dedicated identity restoration specialists to help you resolve the issue.

- Million dollar protection package: LifeLock offers a $1 million protection package, which includes reimbursement for stolen funds, personal expenses, and legal fees, subject to the terms and conditions of the plan.

In addition to the above features, LifeLock Ultimate Plus also includes Norton 360 with LifeLock, which provides antivirus and malware protection for up to 10 devices, as well as a VPN and SafeCam features to help protect your online privacy.

Features of LifeLock

LifeLock offers a range of features to help protect your identity and personal information. The specific features you get depend on the plan you choose, but here are some of the common features across all plans:

- Identity theft protection: LifeLock monitors your personal information, such as your Social Security number and credit card numbers, to detect potential identity theft.

- Dark web monitoring: LifeLock scans the dark web for your personal information and alerts you if it is found.

- Credit monitoring: LifeLock monitors your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) and alerts you to changes that could indicate fraud or identity theft.

- Identity restoration: If you become a victim of identity theft, LifeLock provides dedicated identity restoration specialists to help you resolve the issue.

- Stolen funds reimbursement: LifeLock offers reimbursement for funds stolen due to identity theft, up to the limits of your plan.

- Privacy monitoring: LifeLock monitors your personal information on the internet and public records, such as your address and phone number, to help you maintain your privacy.

- Norton 360 with LifeLock: This is an optional add-on that provides antivirus and malware protection for your devices, as well as VPN and SafeCam features to help protect your online privacy.

Is LifeLock Safe to Use?

Yes, LifeLock is safe to use.

LifeLock is a legitimate identity theft protection service that has been in business since 2005. It is owned by NortonLifeLock, a leading cybersecurity company that provides a range of security products and services.

In terms of the safety of using LifeLock, the company takes a number of measures to protect your personal information. LifeLock uses industry-standard encryption to protect your data, and it has strict policies and procedures in place to ensure the security of its systems and networks. The company also undergoes regular security audits and testing to identify and address any vulnerabilities.

That being said, no service or company can guarantee 100% protection against identity theft. LifeLock is a tool to help you monitor and protect your personal information, but it cannot prevent all forms of identity theft. It’s important to take other steps to protect yourself, such as using strong passwords, being cautious about sharing personal information online, and monitoring your financial accounts regularly.

Overall, if you are looking for an identity theft protection service, LifeLock is a reputable option. However, it’s important to carefully review the details of each plan and understand the limitations of the service before signing up.

LifeLock Reviews

LifeLock has mixed reviews on online review sites. However, it is still considered one of the best identity theft protection services on the market. Here is a summary of how LifeLock is perceived by some of the most popular online review sites:

- Trustpilot: LifeLock has a rating of 4.1 out of 5 stars on Trustpilot, with over 6,000 customer reviews. Many reviewers praise the service for its easy setup and effective monitoring, while others complain about billing issues and poor customer support.

- Consumer Affairs: LifeLock has a rating of 3.6 out of 5 stars on Consumer Affairs, with over 2,400 customer reviews. Positive reviews cite the service’s ease of use and quick alerts, while negative reviews mention billing problems and slow resolution of identity theft issues.

- Better Business Bureau (BBB): LifeLock has an A+ rating from the BBB, but it is not accredited by the organization. The company has over 400 customer complaints filed with the BBB, most of which relate to billing issues.

It’s worth noting that online reviews should be taken with a grain of salt, as they may not necessarily reflect the experience of all customers. It’s important to carefully evaluate the features and benefits of LifeLock and compare it to other identity theft protection services before making a decision.