Social Security identity theft occurs when someone uses your Social Security number (SSN) or other personal information to fraudulently obtain credit, file taxes, or gain employment. This type of identity theft can have serious consequences, as it can damage your credit score, result in tax liabilities or legal trouble, and compromise your ability to obtain credit or employment in the future.

How Does Social Security Identity Theft Occur?

Social Security identity theft can happen in several ways. Here are some common methods used by identity thieves:

- Phishing scams: The thief may send an email or a text message posing as a legitimate institution, such as the Social Security Administration or a financial institution, asking for your personal information, including your Social Security number.

- Data breaches: Hackers can gain access to databases containing personal information, including Social Security numbers, of millions of people. They can then use this information for identity theft.

- Stealing mail: Identity thieves may steal mail from mailboxes or trash cans to obtain documents that contain personal information, such as Social Security statements or tax documents.

- Skimming: Identity thieves can use skimming devices to steal credit card information, which can then be used to open new accounts in your name.

- Employment scams: Identity thieves may use stolen Social Security numbers to obtain employment, which can result in fraudulent income being reported on your tax return.

- Social media: Some identity thieves can gather personal information from social media sites, such as your birthdate, address, and other identifying information, which can be used to steal your identity.

One common method of Social Security identity theft is through phishing attacks, where attackers use deceptive emails or websites to trick individuals into revealing their SSNs and other personal information. These attacks often mimic legitimate organizations, such as banks or government agencies, to appear more credible.

Another technique involves data breaches at companies or government agencies where personal information, including SSNs, is stored. Hackers exploit security weaknesses in the network infrastructure to access and extract this data. Once obtained, these SSNs can be used to open fraudulent accounts, obtain credit, or claim government benefits unlawfully.

Physical theft is also a method, where thieves steal wallets, purses, mail, or go through trash to find documents containing SSNs. These documents can include tax returns, employment records, or other paperwork that individuals might not securely dispose of.

Skimming devices placed on ATMs or gas station pumps are used to capture credit card information, but sophisticated variants can also capture personal information if the device is designed to mimic legitimate data entry points for services requiring SSN authentication.

Social engineering tactics extend beyond digital phishing to include phone scams, where imposters posing as representatives from trusted entities coax victims into divulging their SSNs under the guise of verifying account information or offering unsolicited services.

Insider threats should not be underestimated, as employees with access to personal data within an organization might misuse their privileges to access and sell SSNs on the dark web or to identity thieves.

The emergence of social media and online databases has facilitated the illicit gathering of personal information. Attackers can piece together information from various sources to guess or reset passwords that protect personal information, including SSNs.

Detecting Social Security Identity Theft

Detecting Social Security identity theft can be challenging because thieves can use stolen personal information for a long time before you notice any suspicious activity. However, some signs may indicate that your Social Security number has been compromised. Here are a few things to watch out for:

- Unfamiliar activity on your credit report: Check your credit report regularly to look for any unfamiliar accounts, loans, or credit inquiries.

- Unfamiliar charges on your bank or credit card statements: If you see charges for items or services that you didn’t buy, it could be a sign of identity theft.

- Notices from the IRS or other tax authorities: If you receive a notice from the IRS or another tax authority indicating that you owe taxes on income you didn’t earn, it could be a sign that someone has used your Social Security number to obtain employment.

- Denied credit or loan applications: If you apply for credit or a loan and are denied, it could be a sign that someone has used your Social Security number to open accounts or take out loans in your name.

- Social Security statement discrepancies: If you receive a Social Security statement that shows earnings from a job you didn’t work, it could be a sign that someone has used your Social Security number for employment.

Regularly checking credit reports is crucial; these reports contain details of all accounts opened in one’s name, including any unauthorized accounts that an identity thief might have established using the stolen SSN. Credit monitoring services can provide real-time alerts to new inquiries or accounts, offering an early warning system against identity theft.

Unexpected bills or collection calls for services or loans one did not apply for often indicate that someone else is using the individual’s SSN. Similarly, discrepancies in medical records or notices from health insurance providers about benefits for services not received suggest medical identity theft.

Tax-related identity theft is another red flag, where victims find out that a tax return has already been filed in their name. This typically occurs when a thief uses a stolen SSN to file a fraudulent tax return to steal a tax refund.

Noticing errors or unfamiliar transactions on bank statements and bills can also signal unauthorized use of one’s identity. Thieves might use stolen SSNs to drain existing accounts or open new ones, leading to financial discrepancies.

The Social Security Administration (SSA) provides statements detailing one’s earnings and future benefits. A mismatch in reported earnings suggests someone else might be using the SSN for employment, which is a clear indicator of SSN misuse.

Implementing fraud alerts and security freezes on credit reports adds an extra layer of protection. A fraud alert requires creditors to take extra steps to verify their identity before extending credit, while a security freeze locks the credit report, preventing new creditors from accessing it.

Engaging with identity protection services that offer advanced monitoring of the dark web and other online locations where stolen SSNs might be traded or sold is another proactive measure. These services can alert individuals to potential misuse of their personal information, including their SSN, before significant damage occurs.

It’s essential to stay informed about the latest security breaches and scams. Companies and government agencies often report breaches that could impact personal information, enabling individuals to take preventative measures if their data may have been compromised.

Social Security Identity Theft Protection

Protecting yourself from Social Security identity theft is crucial in today’s digital age. Here are some steps you can take to protect yourself:

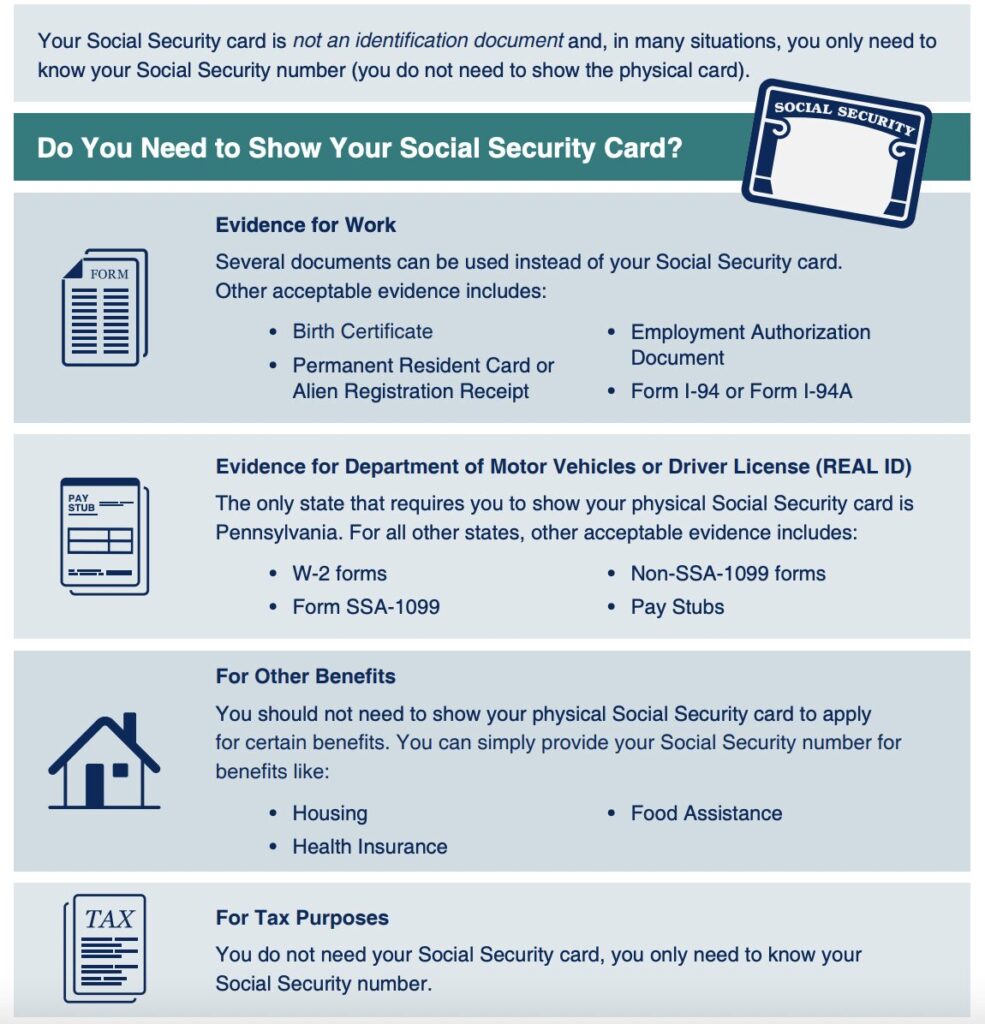

- Safeguard your Social Security number: Do not carry your Social Security card in your wallet or purse. Keep it in a safe place, and only give it out when absolutely necessary.

- Use strong passwords: Use strong, unique passwords for all your online accounts, and avoid using the same password for multiple accounts. Consider using a password manager to keep track of your passwords.

- Be wary of phishing scams: Be cautious of unsolicited emails or phone calls asking for personal information. Do not click on links or download attachments in emails from unknown senders.

- Monitor your credit reports: Review your credit reports from all three credit bureaus regularly to look for any unauthorized activity.

- Protect your mail: Shred documents containing personal information before throwing them away, and consider using a mailbox with a lock to prevent mail theft.

- Keep your software up-to-date: Make sure to install software updates and patches to protect against security vulnerabilities.

- Use two-factor authentication: Use two-factor authentication whenever possible to add an extra layer of security to your accounts.

- Be cautious on social media: Be mindful of the information you share on social media, and adjust your privacy settings to limit who can see your personal information.

Keep your Social Security number (SSN) confidential and share it only when absolutely necessary. Be skeptical of unsolicited requests for your SSN, whether they come via email, phone, or in person, and verify the identity of the requester and the necessity of providing your SSN.

Use strong, unique passwords for all online accounts and enable two-factor authentication wherever it’s available. This adds an extra layer of security, making it more difficult for attackers to gain unauthorized access to your personal and financial accounts even if they manage to obtain your SSN.

Regularly review your credit reports from the three major credit bureaus—Equifax, Experian, and TransUnion. You’re entitled to one free report from each bureau every year, which you can obtain through AnnualCreditReport.com. Monitoring your credit reports helps you spot any unauthorized accounts or transactions that could indicate identity theft.

Implement security freezes on your credit reports. A freeze prevents creditors from accessing your credit report, making it more difficult for identity thieves to open new accounts in your name. While a freeze is in place, you can lift it temporarily using a PIN or password when you legitimately need to apply for credit.

Consider subscribing to a credit monitoring or identity theft protection service. These services monitor your credit and personal information on your behalf and alert you to potentially fraudulent activity. Some services also offer additional features, such as identity theft insurance and recovery assistance.

Be cautious with your mail. Use a secure mailbox for incoming mail and promptly remove mail after delivery. Send outgoing bill payments and sensitive correspondence from post office collection boxes or directly from the post office to reduce the risk of mail theft.

Safeguard personal documents in your home, especially those containing your SSN or other sensitive information. Use a shredder to destroy documents you no longer need.

Be mindful of your online presence. Limit the amount of personal information you share on social media and other online platforms. Cybercriminals can use this information to piece together your identity and potentially guess security questions that could give them access to your accounts.

Keep your computer and other devices secure by installing antivirus and anti-malware software, using a firewall, and keeping all software up to date. Regular updates include patches for security vulnerabilities that could be exploited by hackers.

Social Security Card Protection

Protecting your physical Social Security card requires a secure approach to storage and handling to prevent it from falling into the wrong hands. Keep the card in a safe place at home, ideally in a locked safe or security box that offers protection from theft, fire, and water damage. This ensures the card is secure but accessible when absolutely necessary. Avoid carrying the card in your wallet or purse daily to minimize the risk of loss or theft during your routine activities.

When you do need to carry the card for specific reasons, such as a job interview or to complete government paperwork, place it directly back into your secure storage as soon as you no longer need it. Be mindful of the surroundings when you have the card out of its safe location, ensuring it is not exposed to potential thieves or left unattended.

For an added layer of security, consider using a waterproof and fireproof container to store the card along with other important documents. This protects against environmental damage in addition to theft.

If you must send your Social Security card through the mail, use certified mail or another secure mailing service that allows you to track the shipment and confirm receipt. This reduces the risk of the card getting lost or intercepted.

In case your Social Security card is lost or stolen, report the loss immediately to the Social Security Administration (SSA) to request a replacement and to monitor your credit reports and accounts for any signs of unauthorized use of your SSN. Taking swift action can help mitigate the potential damage caused by the loss of the card.

Educate family members or others living in your home about the importance of maintaining the security of personal documents, including your Social Security card, to ensure everyone understands not to disclose the location or allow access to unauthorized individuals.

Lost and Stolen Social Security Cards

If your physical Social Security card is lost or stolen, immediately contact the Social Security Administration (SSA) to report the loss and request a replacement card. This is crucial as it alerts the SSA to the potential misuse of your Social Security number (SSN). Visit the SSA’s official website or your local SSA office to find out the process and the documents you’ll need to provide for a replacement card.

Next, place fraud alerts with the three major credit reporting agencies, Equifax, Experian, and TransUnion. A fraud alert notifies potential creditors to verify the identity of anyone attempting to open an account in your name, adding an extra layer of protection against identity theft.

Consider placing a credit freeze on your reports. Unlike a fraud alert, a credit freeze restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name. There’s usually no cost to place or lift a freeze, but it must be done separately with each credit bureau.

Monitor your credit reports closely for any unauthorized activity. You’re entitled to one free credit report per year from each of the major bureaus through AnnualCreditReport.com. Review these reports for any accounts or transactions you don’t recognize, which could indicate identity theft.

File a report with your local police department. While the police may not be able to actively recover your lost or stolen Social Security card, having a police report can be helpful when dealing with creditors or if legal issues arise from the theft of your identity.

Change passwords and security questions for any online accounts that may be linked to your SSN, especially financial accounts, to prevent unauthorized access. Consider using a password manager to generate and store strong, unique passwords for each account.

Be vigilant for phishing attempts. Thieves who have your SSN may try to gather more personal information through fraudulent emails or calls. Never provide personal information unless you have initiated the contact and are sure of the recipient’s identity.

Keep an eye on your financial statements and accounts for any signs of unauthorized transactions. If you notice anything suspicious, contact your financial institution immediately to report the activity and protect your accounts.

What to do if You Suspect Social Security Identity Theft

If you suspect that you are a victim of Social Security identity theft, it’s important to take action immediately to minimize the damage. Here are some steps you can take:

- Contact the Social Security Administration: Call the Social Security Administration’s fraud hotline at 1-800-269-0271 to report the theft and get advice on what steps to take next.

- Contact the credit bureaus: Contact each of the three major credit bureaus (Equifax, Experian, and TransUnion) to place a fraud alert on your credit report. This will alert potential creditors to take extra steps to verify your identity before granting credit in your name.

- Review your credit reports: Review your credit reports from all three credit bureaus to look for any unauthorized activity, such as new accounts or loans opened in your name.

- File a police report: File a police report with your local police department and obtain a copy of the report to provide to creditors and credit bureaus.

- Contact the Federal Trade Commission (FTC): File a complaint with the FTC and obtain a free Identity Theft Affidavit, which can be used to dispute fraudulent accounts and transactions.

- Contact your financial institutions: Contact your banks, credit card issuers, and other financial institutions to report the theft and close any accounts that may have been compromised.

- Keep records: Keep detailed records of all the steps you have taken to report the theft and dispute any fraudulent accounts or transactions.

If you suspect Social Security identity theft, act immediately to minimize damage. Contact the three major credit bureaus, Equifax, Experian, and TransUnion, to place fraud alerts on your credit reports. This makes it harder for identity thieves to open more accounts in your name. Consider placing a credit freeze on your reports for greater protection, which prevents creditors from accessing your credit file.

Report the identity theft to the Federal Trade Commission (FTC) via IdentityTheft.gov or by calling their hotline. The FTC will provide you with an identity theft report and a recovery plan, guiding you through the process of securing your identity.

Report Social Security Identity Theft

Report Your Financial ID Theft to the FTC at IdentityTheft.gov

File a report with your local police department. Provide them with as much documentation as possible, including any evidence of the theft and the FTC Identity Theft Report. This report can help in disputing fraudulent transactions or accounts opened in your name.

Contact the Social Security Administration (SSA) to report the misuse of your SSN and inquire about the steps to secure your Social Security benefits. If necessary, the SSA may issue a new SSN in extreme cases of identity theft.

Reach out to the Internal Revenue Service (IRS) if you suspect tax-related identity theft. This includes receiving a notification that more than one tax return was filed in your name or that you have income from an employer you don’t work for. The IRS can provide forms to rectify the situation and secure your tax records.

Monitor your financial accounts closely for any unauthorized transactions or changes. Contact your bank and credit card issuers to report any fraudulent activity and secure your accounts, possibly by closing compromised accounts and opening new ones.

Change passwords and security questions for your online accounts, especially those related to financial information. Use strong, unique passwords and consider using a password manager to keep track of them.

Stay vigilant and regularly check your credit reports and financial statements for signs of unauthorized activity. Monitoring services can help keep an eye on your credit and personal information for any further signs of identity theft.

Educate yourself on the latest phishing scams and social engineering tactics to prevent further exposure of your personal information. Understanding the methods used by identity thieves can help you better protect yourself from future attacks.

Consider seeking legal advice if the identity theft has resulted in significant financial loss or legal complications. A lawyer specializing in identity theft can provide guidance on how to navigate the legal system and potentially recover losses.

Bottom Line

If you suspect that your Social Security number has been compromised, it’s important to take action immediately. You should contact the Social Security Administration and the Federal Trade Commission (FTC) to report the theft and obtain advice on how to protect yourself. You should also monitor your credit reports regularly to ensure that no new accounts or loans have been opened in your name without your permission.

2025 Data Sources