Lexington Law is a law firm that specializes in credit repair services. The firm provides legal services to clients seeking to improve their credit reports and scores by disputing inaccurate or incomplete information that may be harming their creditworthiness.

Lexington Law works on behalf of their clients to investigate and dispute negative items on their credit reports, such as late payments, charge-offs, collections, bankruptcies, foreclosures, and judgments. The firm uses various legal strategies to challenge these items and seek their removal or correction from the credit bureaus.

Lexington Law also provides clients with credit counseling and education to help them better understand credit reports and scores, and how to manage their finances more effectively.

It’s important to note that Lexington Law is not a credit counseling agency, debt consolidation company, or loan provider. Their services are focused solely on credit repair and helping clients improve their credit scores.

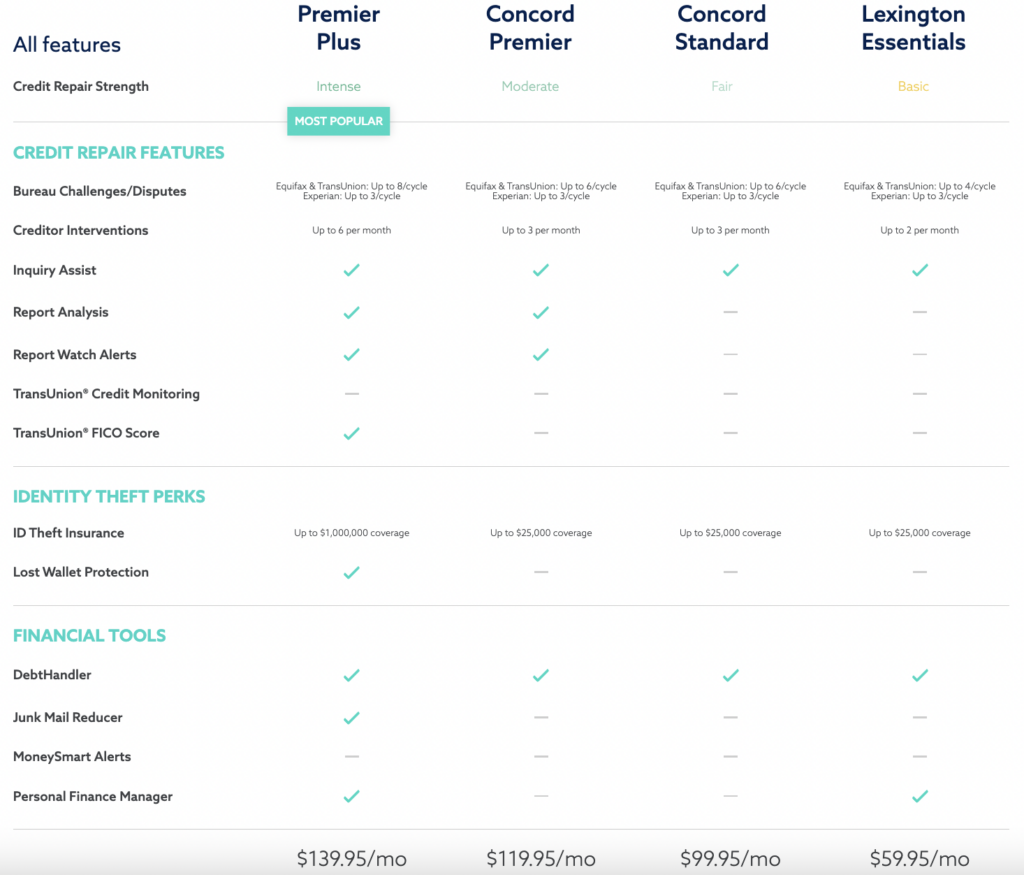

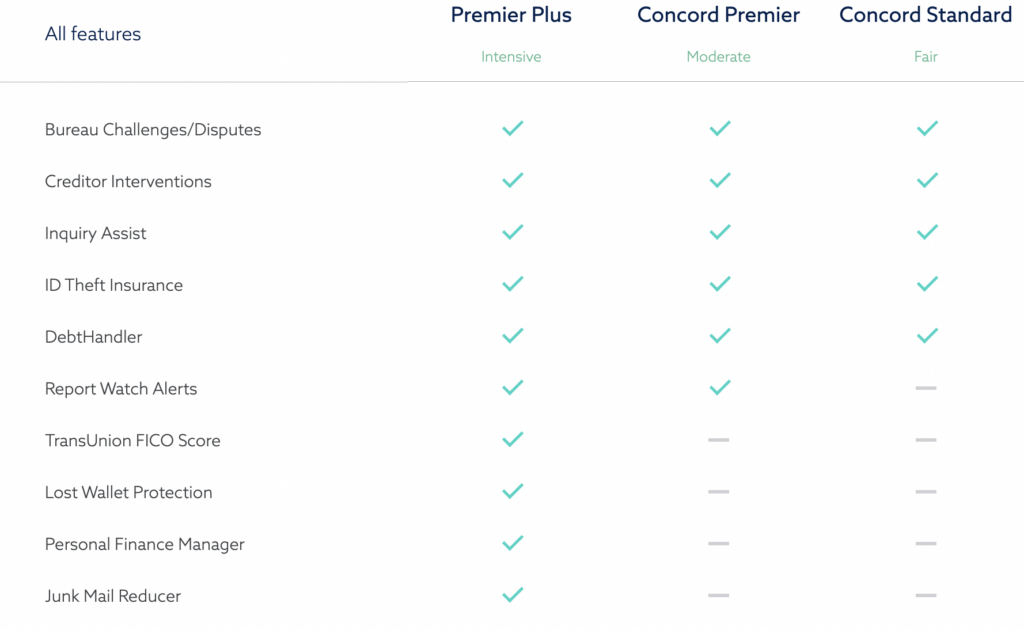

Lexington Law Credit Repair Cost and Pricing Plans

- Lexington Essentials: $59.95 per month

- Concord Standard: $99.95 per month

- Concord Premier: $119.95 per month

- Premier Plus: $139.95 per month

Lexington Law has different pricing and plans for various customers, depending on their needs. Here is a breakdown of their services:

Lexington Essentials

The Lexington Essentials plan is the most basic plan and provides customers with the most basic tools they need to manage finances for $59.95 per month. It includes 2 creditor interventions per month.

Concord Standard

The Concord Standard plan is the second most basic plan at goes for $99.95 per month. This plan is similar to Lexington Essentials but includes 3 credit interventions per month. The plan also helps answer bureau and creditor challenges filed on the credit report. Customers can use this plan to ensure that credit reporting firms report their finances correctly.

Concord Premier

Concord Premier is the next choice for customers at Lexington Law as it offers powerful tools for credit repair needs. Customers get a monthly credit report analysis and monitoring which aren’t in the standard plan. It is an excellent way to stay on a budget and still assess finances professionally.

The plan costs $119.95 per month, making it relatively affordable for most customers needing credit repair.

Premier Plus

The Premier Plus option at Lexington Law comes with world-class credit reporting options for $139.95 per month. These include tracking and analyzing FICO scores. The subscription can also provide legal assistance and suggestions for dealing with credit reporting bureaus.

Lexington Law understands how likely customers are to face identity theft, which is why it offers identity theft coverage for a million dollars. It is one of the best options for anyone suffering from identity theft.

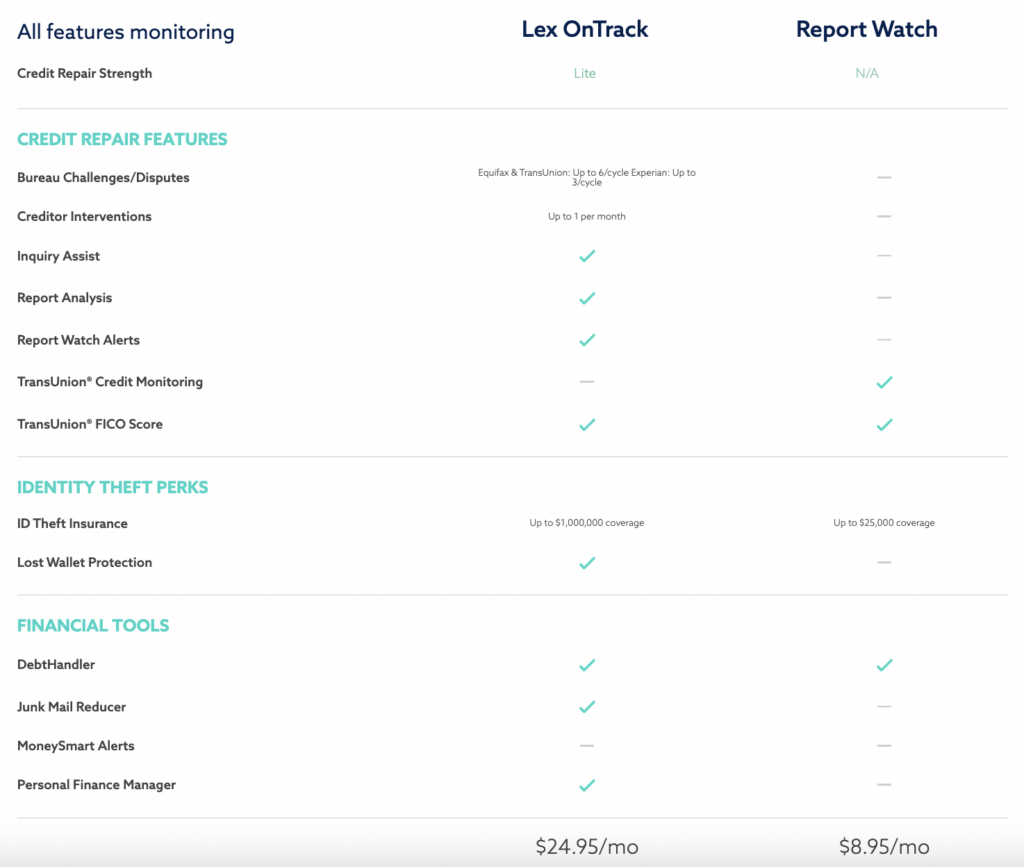

Lexington Law Credit Monitoring Cost and Pricing Plans

- Report Watch: $8.95 per month

- Lex OnTrack: $24.95 per month

Lexington Law also offers credit monitoring services. They have 2 plans: Report Watch and Lex OnTrack. A breakdown of each service can be found below:

Lexington Law Services and Offerings

Lexington Law offers a range of credit repair services aimed at helping clients improve their credit scores and overall creditworthiness. Some of the key services provided by Lexington Law include:

- Credit Report Analysis: The firm provides a comprehensive analysis of clients’ credit reports to identify any inaccurate, incomplete, or outdated information that may be negatively impacting their credit scores.

- Credit Dispute: Lexington Law challenges and disputes negative items on clients’ credit reports, including late payments, collections, bankruptcies, foreclosures, judgments, and other types of derogatory information.

- Credit Score Coaching: The firm provides clients with personalized credit score coaching to help them better understand their credit reports and scores, as well as ways to improve their credit standing over time.

- Credit Monitoring: Lexington Law offers credit monitoring services to help clients stay on top of any changes to their credit reports and scores, as well as to alert them to potential fraud or identity theft.

- Identity Theft Protection: The firm provides clients with identity theft protection services, including credit monitoring and alerts, to help prevent and mitigate the effects of identity theft.

- Cease and Desist: Lexington Law can also help clients stop harassing or abusive debt collection calls and letters by sending a Cease and Desist letter to the creditors or collection agencies.

It’s worth noting that Lexington Law provides legal services and representation to clients in matters related to credit repair, but they cannot guarantee any specific outcomes or results. The effectiveness of their services may vary depending on individual circumstances and the specific items being disputed on the credit reports.

Bottom Line

Lexington Law has impressive features and affordable pricing plans. The firm’s services are ideal for customers who want to ensure financial stability and increase their credit scores. You can contact Lexington Law’s professionals through their website for more information.