A credit repair service is a company that offers to improve a person’s credit score by reviewing their credit reports, identifying errors or inaccuracies, and disputing those errors with the credit reporting agencies on their behalf. These services may also provide guidance on how to build credit and improve credit habits.

Credit repair services typically charge a fee for their services, which can vary depending on the extent of the work required to repair the individual’s credit. It is important to note that while credit repair services can assist in disputing errors on credit reports, they cannot guarantee a specific outcome or improve credit scores in all cases.

It is also important to be cautious when selecting a credit repair service, as there are many scams and fraudulent companies in this industry. Consumers should research the company thoroughly, including checking for complaints with the Better Business Bureau and reading reviews from other customers. It is also recommended to seek advice from a trusted financial advisor or credit counseling agency before engaging with a credit repair service.

Cost of Credit Repair Services

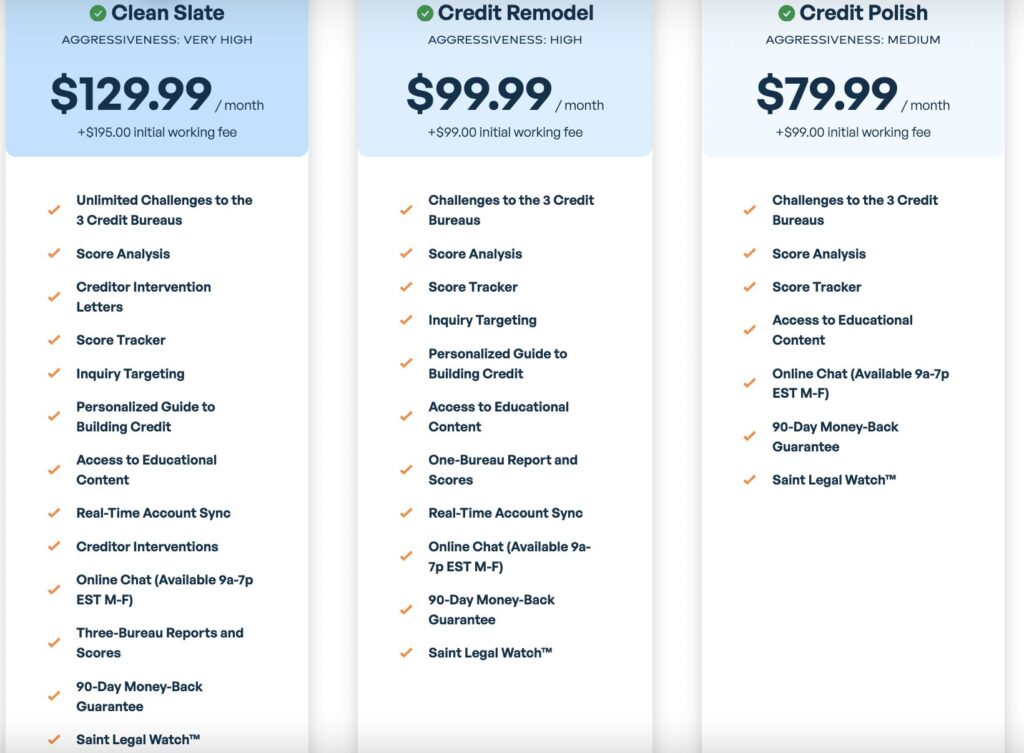

Credit repair services come at various price points, depending on the complexity of the issues on your credit report and the level of service you choose. Monthly fees for credit repair services typically range from $69 to $149, with the process often taking several months up to a year to see substantial results. It’s also common for credit repair companies to charge an initial setup fee in addition to the monthly service fee.

Credit repair costs can accumulate over time, especially if the service extends over several months. For example, a monthly fee of $150 could result in a total cost of around $900 if the credit repair process takes about six months. The exact fees and the duration of the service can vary widely based on the specific challenges on your credit report and the credit repair company’s pricing structure.

It’s important to note that while credit repair services can assist in disputing errors and negotiating with creditors, they cannot legally remove accurate, timely, and verifiable negative information from your credit reports. The Credit Repair Organizations Act (CROA) mandates that credit repair companies must provide a detailed written contract specifying the services they will perform, the total cost, and the timeframe for results. It also gives consumers a three-day right to cancel the service without charge.

Repairing Credit Damage From Identity Theft

Credit repair services can be used to help recover from identity theft by assisting in the process of disputing fraudulent activity on a person’s credit reports. When a person becomes a victim of identity theft, their personal information such as name, address, social security number, and credit card details are stolen or used without authorization. This can lead to fraudulent accounts being opened in their name or unauthorized transactions being made, which can negatively impact their credit scores.

Credit repair services can help in several ways:

- Identifying fraudulent accounts: Credit repair services can review a person’s credit reports to identify any accounts that were opened fraudulently or without their knowledge. They can then dispute these accounts with the credit reporting agencies on behalf of the person.

- Disputing inaccuracies: Credit repair services can help dispute any inaccuracies on a person’s credit report resulting from identity theft. For example, they can challenge late payments or delinquencies that were a result of the identity theft.

- Assisting with creditor communication: Credit repair services can also communicate with creditors and debt collectors to resolve issues resulting from identity theft. They can work to have fraudulent accounts closed and any unauthorized charges removed.

Credit repair services can play a critical role in resolving the financial damage caused by identity theft. These services employ a range of strategies tailored to address the specific challenges that arise from fraudulent activity on your credit reports. Initially, credit repair professionals conduct a comprehensive review of your credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion. This step is crucial for identifying any discrepancies, fraudulent accounts, or transactions that you did not authorize.

Once these issues have been identified, credit repair specialists leverage their expertise to dispute inaccuracies directly with the credit bureaus. This process involves gathering evidence, such as police reports or letters from creditors confirming the fraudulent nature of the accounts, and submitting formal dispute letters. The credit bureaus are legally obligated to investigate these disputes within 30 days, providing a timely mechanism for removing unauthorized entries from your credit report.

In cases of identity theft, it’s also common for credit repair services to engage directly with creditors and debt collectors. By presenting evidence of identity theft, they can request the removal of fraudulent accounts from your credit history. This direct negotiation is essential because it addresses the root of the credit report inaccuracies, ensuring that the fraudulent information does not simply reappear after being initially removed.

Credit repair services often go beyond dispute resolution by offering ongoing credit monitoring and identity theft protection. This proactive approach is designed to quickly identify and address new instances of fraud, minimizing potential damage to your credit score. By monitoring your credit report and scores, these services can alert you to any unusual activity, enabling swift action to prevent further harm.

Reputable credit repair services provide clients with guidance on securing their personal information and preventing future instances of identity theft. This may include recommendations for enhancing online security, using credit freezes, and adopting best practices for financial privacy.

It’s important to recognize that while credit repair services can significantly aid in recovering from identity theft, they operate within the bounds of the law. They cannot remove legitimate negative information that predates the identity theft. Their expertise in navigating the complexities of credit reporting and their ability to act swiftly can make a substantial difference in mitigating the impact of identity theft on your financial health.

List of Popular Credit Repair Services

To learn more, read our list of the best credit repair services.

2024 Data Sources

- https://consumer.ftc.gov/articles/fixing-your-credit-faqs

- https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/

- https://www.usa.gov/credit

- https://playmoneysmart.fdic.gov/tools/110

- https://www.justice.gov/ust/list-credit-counseling-agencies-approved-pursuant-11-usc-111

- https://www.fdic.gov/resources/consumers/consumer-assistance-topics/credit-reports.html

- https://www.annualcreditreport.com/index.action