Identity theft is a serious concern for individuals not only in the US but globally. Identity theft issues have been a common concern for several years and its frequency has sky-rocketed in the past few years. So much so that the market for identity theft protection services is expected to reach $28 billion by 2029.

As we begin the year 2025, the current identity theft statistics in the country appear to show another year of ever-increasing cybersecurity issues. Let us take a quick look at some facts as to why identity theft is a growing problem in the United States.

Identity Theft Statistics: The Fast Facts

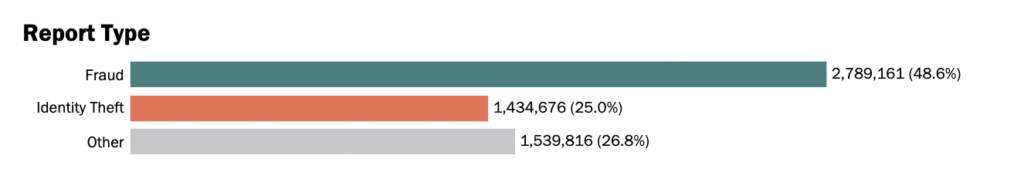

- The FTC received 5.7 million total fraud and identity theft reports, 1.4 million of which were identity theft cases

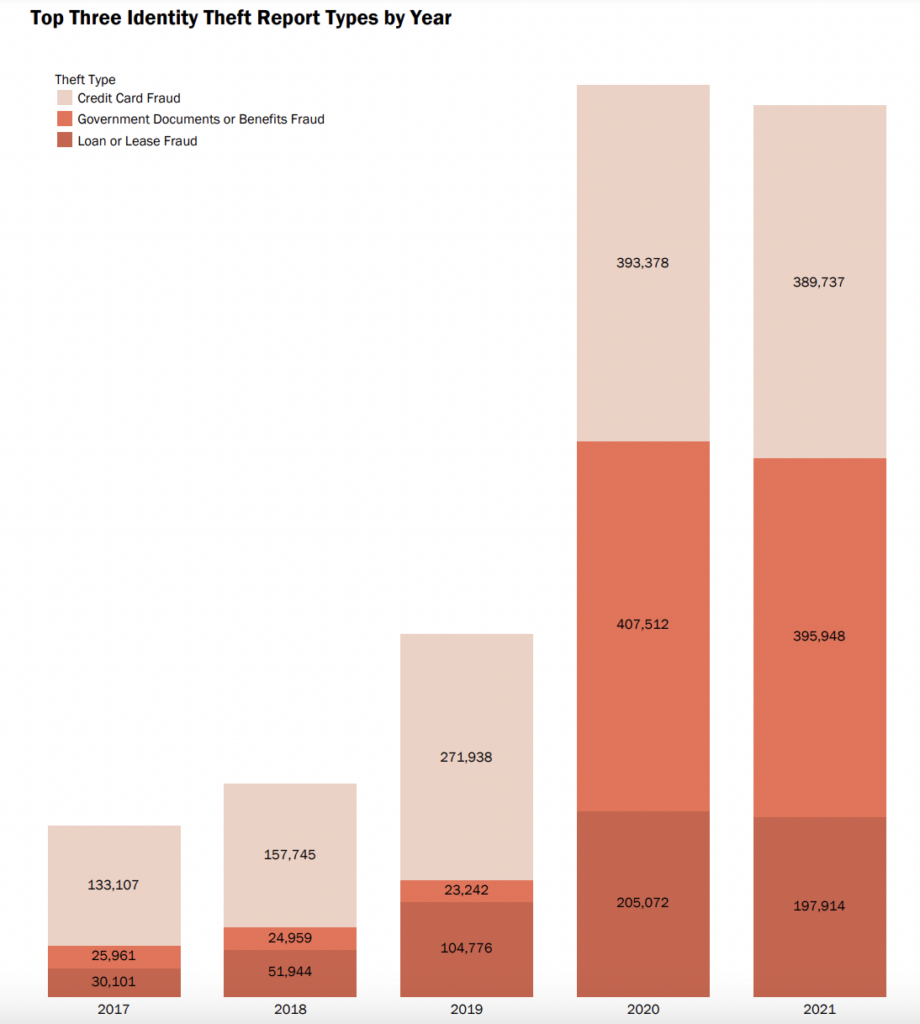

- Government Documents or Benefits Fraud tops the list of identity theft types with 395,948 reported cases

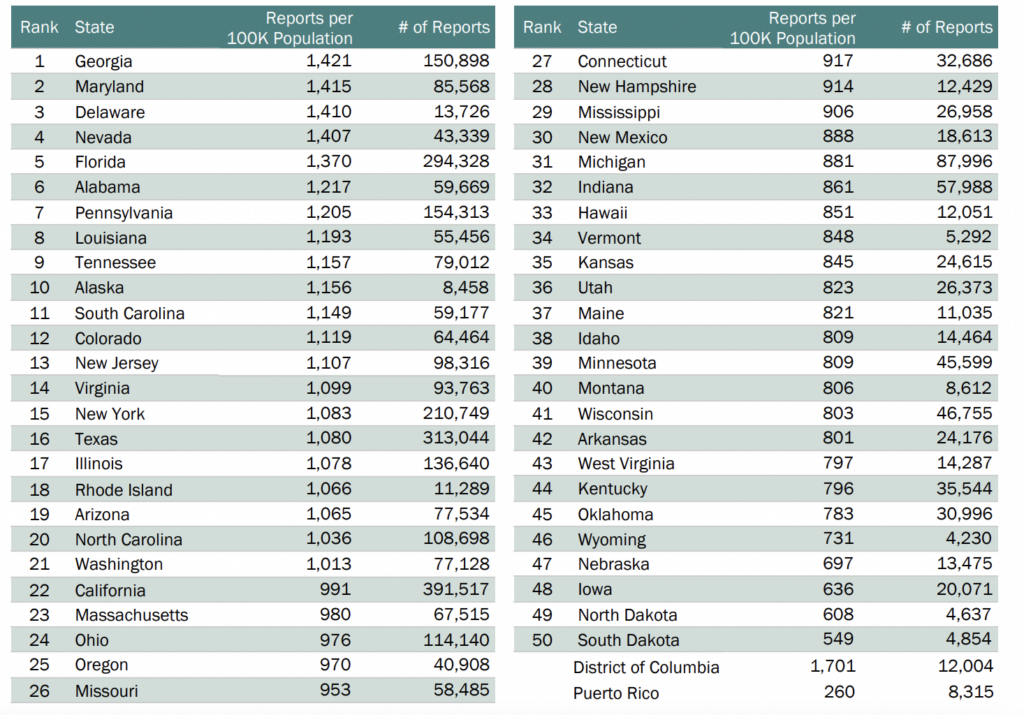

- Georgia reported the most identity theft cases

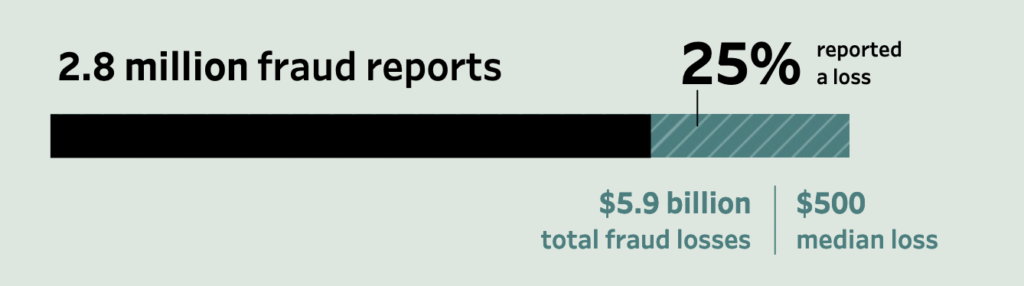

- The median loss of fraud cases for victims is about $500

- Total losses are estimated to be $10.2 billion

Identity Theft Statistics, Data, and Facts for 2025

Identity theft scenarios are increasing drastically in 2025. Take a look at the development of these identity theft cases in the past few years to get a clearer idea of the current situation.

The FTC Received 1.4 Identity Theft Reports

Of the total 5.7 million cases reported to the FTC, 1.4 million (25%) were specific to identity theft. The FTC classifies identity theft into a specific category in its reporting that is separate from fraud.

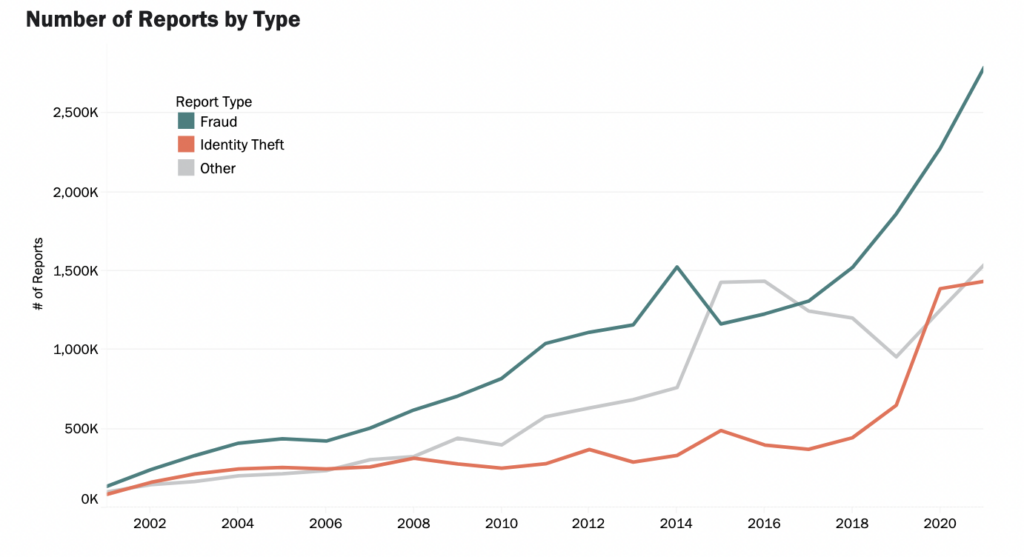

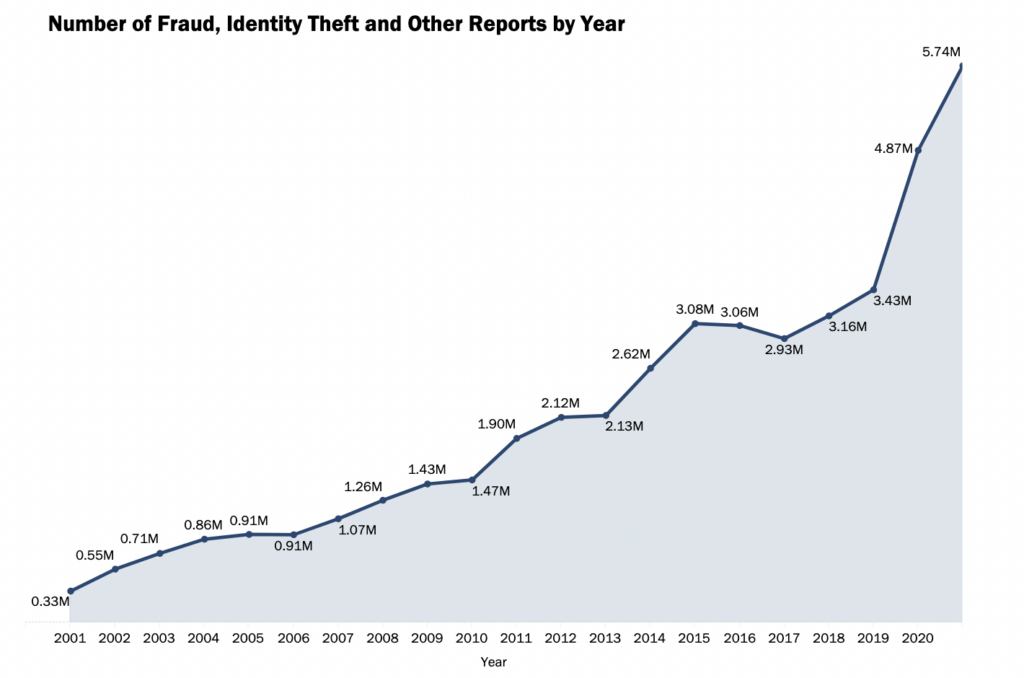

Total Fraud and Identity Theft Cases Have Nearly Tripled Over the Last Decade

Identity theft and fraud cases have been steadily increasing over the past decade.

Cybercrime Losses Totaled $10.2 billion

According to the FBI, total cybercrime losses are estimated to be $10.2 billion. This is nearly double the amount of the previous year ($6.9 billion).

The Median Loss to Fraud Victims is $500

With a $500 median loss, the cost to victims is growing as we become more digitally dependent.

5.7 Million Cases of Fraud and Identity Theft Were Reported to the FTC

The FTC received 5.7 million reports of identity theft and fraud, up from 4.7 million the previous year.

There is an Identity Theft Case Every 22 Seconds

Identity theft cases are at an all-time high, because of a wider range of identity theft methods. Simple methods such as traditional identity theft, to more complicated ones like synthetic identity theft, are all increasing.

Experts believe that these cases occur so often that there is a new victim every 22 seconds. Most studies indicate that this ratio will increase in 2025, making it a bigger issue for Americans.

Total Credit Card Fraud Cases Decreased to 389,737

Total credit card fraud cases were 389,737 which was actually down from 393,737 the previous year.

33% of Americans Faced Some Form of Identity Theft at Some Point in Their Lives

The number of identity theft scenarios in the U.S. is nearly 3 times higher than in other countries. Reports indicate that nearly 33% of Americans have faced some kind of identity theft attempt in their lives. Experts indicate that this number could increase significantly this year.

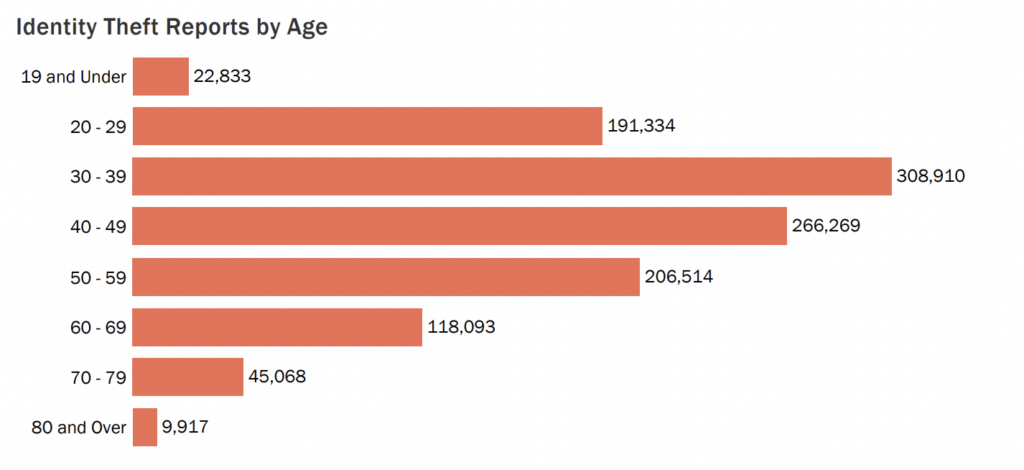

Consumers Aged 30-39 Were the Most Victimized

Those who fall into the age range of 30-39 were most victimized by identity theft.

Georgia Ranked #1 for Identity Theft and Fraud Cases

Per capita, Georgia was the most victimized by identity theft and fraud, followed closely by Maryland and Delaware.

Bottom Line

Identity theft has been a growing problem in the U.S. for the past few years. It is difficult for victims to deal with these issues because theft methods are becoming even more sophisticated with time. Citizens must safeguard their personal information by utilizing technology such as antivirus protection software, password managers, identity theft protection, and VPNs if they want to avoid identity theft scenarios in 2025.

Related Research and Statistics

Consumer Cybersecurity Solutions

- LifeLock Review and Pricing Plans

- Surfshark Review and Plan Costs

- NordVPN Review and Cost

- NordPass Review and Plans

- DeleteMe Review and Pricing Plans

2025 Data Sources