Venmo is a mobile payment service owned by the publicly traded company, PayPal. It allows users to transfer money to others using the app. It’s available on iOS and Android devices, and it syncs with your bank account or debit/credit card to send or receive payments.

Venmo operates by creating a simple way to pay friends or family back for meals, split cab fares, pay rent, and more. The app also integrates a social element, where you can choose to make your transactions public (the amount is hidden) to your friends or private. Users often add a memo or emoji to their payments to indicate what it was for.

Is Venmo Safe?

Yes, Venmo is safe to use. It uses encryption to keep transactions and app data secure. The company uses data encryption to protect users against unauthorized transactions and allows users to set up a PIN code for mobile application access.

However, there are some considerations to keep in mind:

- Privacy Settings: Make sure to adjust your privacy settings to control who can see your transactions. By default, all your contacts can view your transactions unless you change the settings.

- Friends Only: Only send money to people you personally know. If you send money to a stranger for a product or service, you have very little recourse if they don’t provide what was promised.

- No Business Transactions: As of my last update, Venmo states in their user agreement that their platform should not be used for business transactions. This type of use is not only against their rules, but also doesn’t provide the buyer or seller protection that other platforms do.

- Internet Scams: Beware of common internet scams. Never send money to someone who asks for it over the internet, especially if you don’t know them personally.

- Account Access: Don’t share your Venmo login credentials with anyone.

Venmo Security Measures

Venmo uses several security measures to protect users’ accounts and maintain the integrity of their platform:

- Data Encryption: Venmo uses data encryption to secure users’ financial information. This means the user’s account information stored on servers is kept in a coded form that hackers can’t easily decipher.

- Secure Connection: When you are using the Venmo app or website, your connection is encrypted with Secure Sockets Layer (SSL) or Transport Layer Security (TLS). This technology protects your information by encrypting data during transmission so that it can’t be read as it’s sent over the internet.

- Account Verification: Venmo also uses account verification methods when setting up a new account or linking a new payment method. This can help prevent someone else from using your account without your permission.

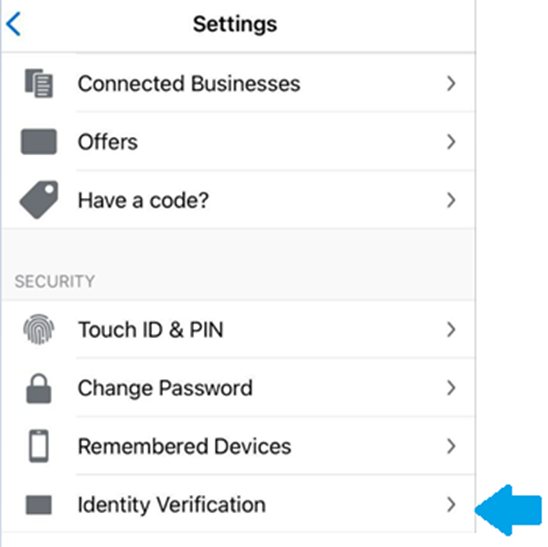

- Two-Factor Authentication (2FA): Venmo offers 2FA to add an extra layer of security to your account. This means when you sign in, you’ll need your password plus a code sent to your phone to access your account.

- Session Timeouts: To protect your account in case you accidentally leave it logged in on a device, Venmo will automatically log out of inactive sessions.

- PIN Codes: Venmo allows users to set up a PIN for an additional layer of security, especially on mobile devices.

These security measures are meant to keep your Venmo account as safe as possible. However, security is a two-way street, and users should also take precautions such as using strong, unique passwords, keeping their app updated, and monitoring their transaction history for any unauthorized activity.

Venmo Scams

There are several types of scams that can happen on platforms like Venmo. Here are a few that you should be aware of:

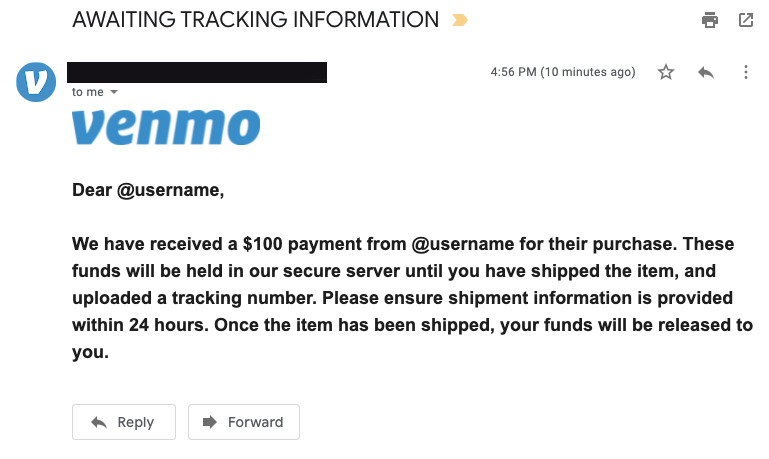

- Payment Cancellations: This scam involves someone sending you money on Venmo, and once you provide the service or product, the person cancels the Venmo payment. Always wait for payments to fully process before handing over goods or services.

- Overpayment Scams: Scammers send a payment larger than the cost of the item you are selling, and then ask you to refund the difference. Once you send the refund, they cancel the original payment, leaving you with a loss.

- Check Cashing Scams: In this scam, someone asks you to deposit a check into your bank account, and then send them a portion of the money on Venmo. The check later turns out to be fake, leaving you liable for the entire amount.

- Buying Scams: This scam typically involves online marketplaces. The scammer will ask for payment through Venmo, but once the payment is made, they don’t deliver the goods.

- Phishing Scams: These scams involve fake emails or texts impersonating Venmo, asking for your login information or other personal details. Always make sure you’re communicating with official Venmo representatives and never share your password.

- Friend Scams: You might receive a Venmo payment request from someone who appears to be a friend, but it’s actually a scammer who created an account with a similar name. Always double-check the username before accepting payment requests.

To avoid scams, it’s best to use Venmo only with people you personally know and trust, and for its intended use – payments among friends. Always check the status of payments and make sure they’ve been fully processed, not just received, before providing goods or services. And remember, Venmo doesn’t offer buyer or seller protection.

Is Venmo Insured?

Funds stored in your Venmo account are not insured by the Federal Deposit Insurance Corporation (FDIC). Venmo is not a bank and does not offer the consumer protections that a bank does, such as FDIC insurance.

Venmo is designed to be a way to quickly send money to people you know and trust. So, it’s best to transfer any received funds out of your Venmo account and into your bank account as soon as possible. This is especially important because if Venmo were to go out of business or experience a security breach, your money stored in Venmo might not be protected.

In contrast, PayPal, Venmo’s parent company, does provide some protections for buyers and sellers, but these do not typically extend to peer-to-peer transactions like those made through Venmo.

How to Keep Your Venmo Account Safe

Keeping your Venmo account safe is vital. Here are several steps you can take to protect your account:

- Use a Strong, Unique Password: Create a unique password for Venmo that you don’t use for any other online accounts. It should be long, complex, and involve a mix of letters, numbers, and special characters.

- Enable Multifactor Authentication (MFA): This provides an additional layer of security by requiring two or more forms of identification before allowing access to your account. This usually involves something you know (like a password) and something you have (like a phone to receive a text code).

- Only Use Venmo with People You Trust: Venmo is designed for payments between friends and people who trust each other. Avoid paying someone you don’t know through Venmo, as there are limited protections for these types of transactions.

- Keep Your App Updated: Venmo, like other tech companies, regularly updates its app to introduce new features and patch security vulnerabilities. Make sure you have the latest version of the app to benefit from these updates.

- Monitor Your Account: Regularly review your Venmo transaction history for any signs of unauthorized activity.

- Set Up PIN Code: Venmo offers the ability to set up a PIN code for mobile application access. This means even if someone gets a hold of your phone, they won’t be able to send money without knowing your PIN.

- Be Cautious of Scams: Be cautious of anyone who overpays you or asks for money back, requests that you accept a check on their behalf, or sends unsolicited requests for money. These are common signs of a scam.

- Set Your Transactions to Private: By default, your Venmo transactions are public and can be seen by your friends on the app. Consider changing this setting to make your transactions private.

- Never Share Your Login Information: Your username and password are for your eyes only. Never share them with anyone.

How to Report Venmo Fraud

If you believe you have been a victim of fraud or a scam involving your Venmo account, there are a few steps you can take:

- Contact Venmo Support Immediately: You can reach out to Venmo’s customer service via their website or app. Explain the situation in detail, providing as much relevant information as possible.

- Change Your Account Information: Update your password and any other security information related to your account.

- Monitor Your Account Activity: Keep an eye on your account for any unauthorized activity.

- Contact Law Enforcement: If the amount is substantial or if you feel it’s necessary, you may want to involve local law enforcement as well.

- Report to the FTC: You can also file a complaint with the Federal Trade Commission (FTC) through their website.

Remember, Venmo is intended for payments between people who know and trust each other. Be cautious when transacting with individuals you don’t know personally, and always double-check the information before sending money.