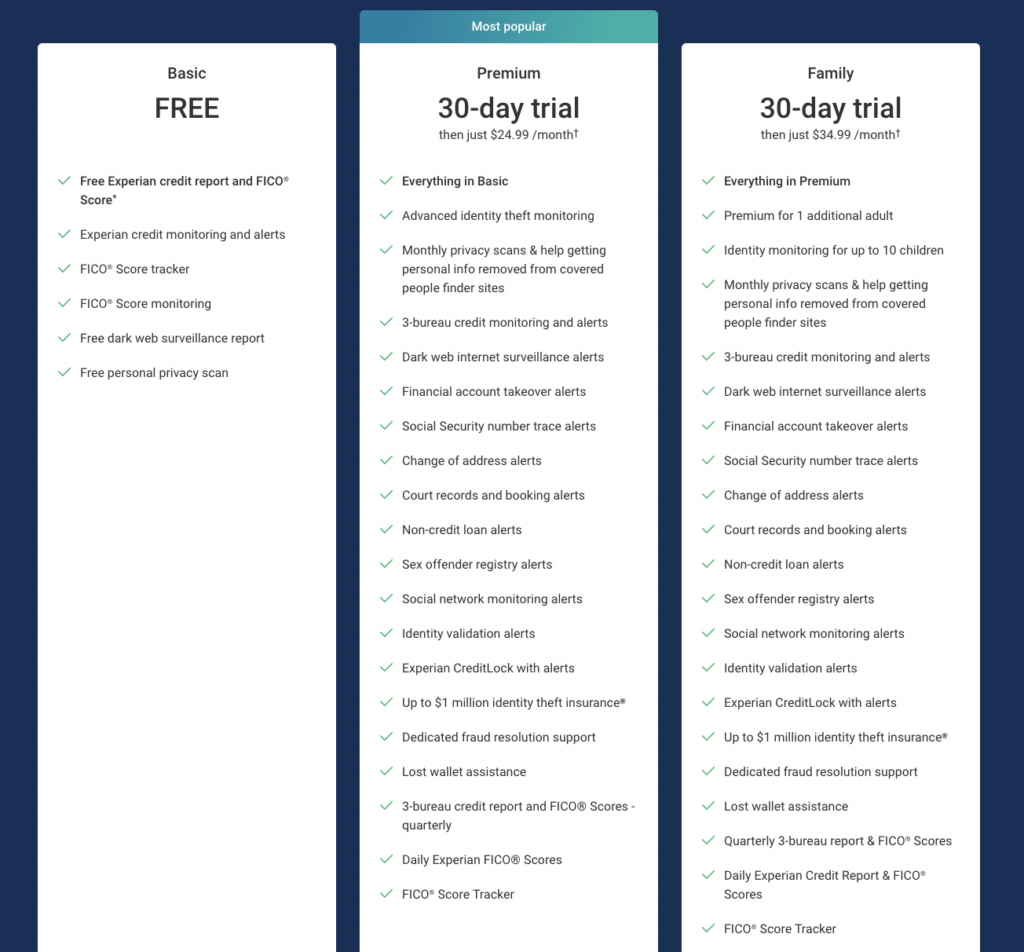

Experian IdentityWorks offers 3 different plans depending on the features and the number of people you want to be protected:

- Free: $0 for the life of the plan.

- Premium: $24.99 per month. Covers 1 adult.

- Family: $34.99. Covers 2 adults and up to 10 children.

Features of Experian IdenityWorks

Experian IdentityWorks offers the following features:

- Dark web surveillance: This feature scans the dark web for your personal information, including your Social Security number, driver’s license number, and credit card numbers.

- Experian credit monitoring: This feature monitors your credit report for any changes or suspicious activity, such as new accounts opened in your name, changes to your address, or late payments.

- Identity theft insurance: Both plans offer up to $500,000 in identity theft insurance to help cover expenses related to identity theft, such as lost wages and legal fees.

- Fraud resolution support: Experian provides dedicated support to help you resolve any issues related to identity theft or fraud, including assistance with credit freezes, fraud alerts, and disputing fraudulent charges.

- Lost wallet protection: If you lose your wallet, Experian will help you cancel and replace your credit cards and other important documents.

- Social Security number monitoring: This feature scans public records to monitor your Social Security number for any unauthorized use.

- Monthly credit reports: The Premium plan includes monthly credit reports from all three major credit bureaus, which can help you stay on top of your credit and spot any suspicious activity.

Is Experian IdentityWorks Safe to Use?

Experian IdentityWorks is generally considered safe to use, as it is offered by Experian, a well-known and reputable credit reporting agency. Experian has been in business for over 125 years and has a solid reputation for providing credit reports and identity theft protection services.

Experian IdentityWorks also uses industry-standard security measures to protect users’ personal and financial information, including encryption, firewalls, and secure servers making it one of the best identity theft protection services. Additionally, the service offers up to $500,000 in identity theft insurance to help cover expenses related to identity theft.

However, no identity theft protection service can guarantee complete protection against identity theft, as there is always some level of risk involved. It’s important to use Experian IdentityWorks in conjunction with other best practices for protecting your identity, such as regularly monitoring your credit reports, safeguarding your personal information, and being cautious when sharing sensitive information online.