Criminal identity theft occurs when a person uses someone else’s personal information, such as their name, social security number, or date of birth, to commit a crime. The criminal may use this information to obtain credit cards, loans, or to open bank accounts. They may also use the information to obtain a driver’s license or to get a job.

In some cases, the criminal may be arrested for a crime, and they will give the victim’s personal information to law enforcement. This can result in the victim being falsely accused of a crime they did not commit. Proving your innocence in this situation can be challenging and time-consuming.

How Does Criminal Identity Theft Occur?

Criminal identity theft unfolds through various methods, each leveraging technology and social engineering tactics to illicitly obtain and exploit personal information.

Phishing campaigns stand out as a prevalent strategy, where attackers craft emails or text messages mimicking legitimate organizations to deceive individuals into divulging sensitive details. These communications often contain malicious links or attachments designed to harvest personal data when clicked or opened.

Another method involves data breaches, where hackers infiltrate databases of corporations or government entities to access vast amounts of personal information. Such breaches can expose names, social security numbers, addresses, and more, making individuals vulnerable to identity theft.

Skimming devices installed on ATMs or point-of-sale systems represent another vector for criminal identity theft. These devices capture card information and PINs, which perpetrators use to clone cards or perform unauthorized transactions. Social media platforms can inadvertently facilitate identity theft. Oversharing personal information on these platforms gives criminals fodder to piece together identities or answer security questions that protect sensitive accounts.

Sophisticated cybercriminals also deploy malware, including spyware and ransomware, to infiltrate personal computers or networks. Once installed, this malware can log keystrokes, steal documents containing personal information, and send the data back to the attacker. Furthermore, exploiting public Wi-Fi networks, which often lack strong encryption, allows thieves to intercept data transmitted over these networks, capturing login credentials and other personal information.

In some instances, criminals resort to old-fashioned methods like dumpster diving, retrieving discarded documents that contain personal information, or directly stealing personal belongings such as wallets and purses to obtain identification documents.

Detecting Criminal Identity Theft

Detecting criminal identity theft can be challenging, as the criminal may have used the victim’s information to commit a crime without their knowledge. However, there are some signs that can indicate that you may be a victim of criminal identity theft. Here are some of the most common indicators:

- You receive unexpected bills or statements: If you receive bills or statements for credit cards or other accounts that you did not open, this may be a sign of criminal identity theft.

- You are denied credit: If you apply for credit and are denied, this could be a sign that someone has used your personal information to open accounts or obtain loans in your name.

- You receive collection calls or notices: If you receive collection calls or notices for debts that you did not incur, this could be a sign of criminal identity theft.

- Your credit report shows unauthorized accounts: Review your credit report regularly to look for any unauthorized accounts or transactions.

- You are contacted by law enforcement: If you are contacted by law enforcement regarding a crime you did not commit, this could be a sign that your identity has been stolen.

Regular review of bank and credit card statements for unauthorized transactions is a fundamental step. Discrepancies, no matter how small, can indicate unauthorized use of your identity. Credit reports play a critical role in early detection; obtaining reports from major credit bureaus annually helps identify any unfamiliar accounts or inquiries, suggesting someone else may be using your personal information.

Setting up fraud alerts with credit bureaus is another effective measure. These alerts notify you when someone attempts to open an account in your name, providing an additional layer of protection. Similarly, credit monitoring services can track your credit file and alert you to changes that might indicate fraud, such as new accounts being opened or significant changes in your credit score.

Beyond financial indicators, pay attention to signs such as missing mail or bills, which could suggest an address change by an identity thief. Receiving unexpected legal notices or summonses for actions you did not take can also indicate that your identity has been compromised for criminal activities.

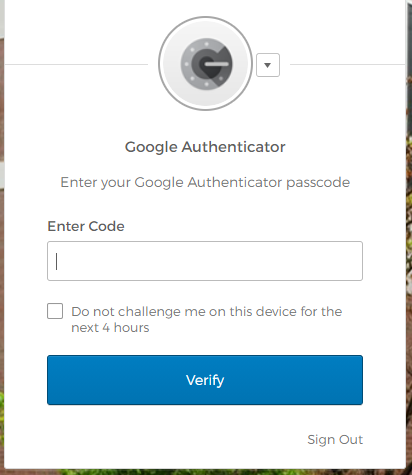

Leveraging identity theft protection services can automate the monitoring process. These services scan various databases and the dark web for your personal information, alerting you to potential exposure. Implementing strong, unique passwords across all accounts and enabling two-factor authentication wherever possible reduces the risk of unauthorized access, making it harder for criminals to exploit your information.

For individuals who have already fallen victim to identity theft, a sudden loss of government benefits or notifications of duplicate Social Security claims can be red flags, indicating that someone else is using your Social Security number for employment or other fraudulent purposes.

Engaging directly with law enforcement or legal professionals when you suspect identity theft is crucial. They can provide guidance on the steps to take, including filing a report, which is often necessary for disputing fraudulent charges and clearing your name. Awareness and prompt action are key to mitigating the damage caused by criminal identity theft.

Criminal Identity Theft Protection

Protecting yourself from criminal identity theft requires being proactive and taking steps to secure your personal information. Here are some tips to help you protect yourself:

- Keep your personal information secure: Avoid carrying your social security card or other sensitive documents with you. Instead, keep them locked up in a secure location, such as a safe or a locked file cabinet.

- Use strong passwords: Use strong passwords that are difficult to guess, and avoid using the same password for multiple accounts.

- Monitor your accounts: Keep a close eye on your bank accounts and credit cards, and report any suspicious activity immediately.

- Shred sensitive documents: Before throwing away any documents containing personal information, such as bank statements or credit card receipts, be sure to shred them.

- Be wary of phishing scams: Be cautious of any unsolicited emails or text messages asking for personal information. Don’t click on any links or download any attachments unless you are absolutely sure they are legitimate.

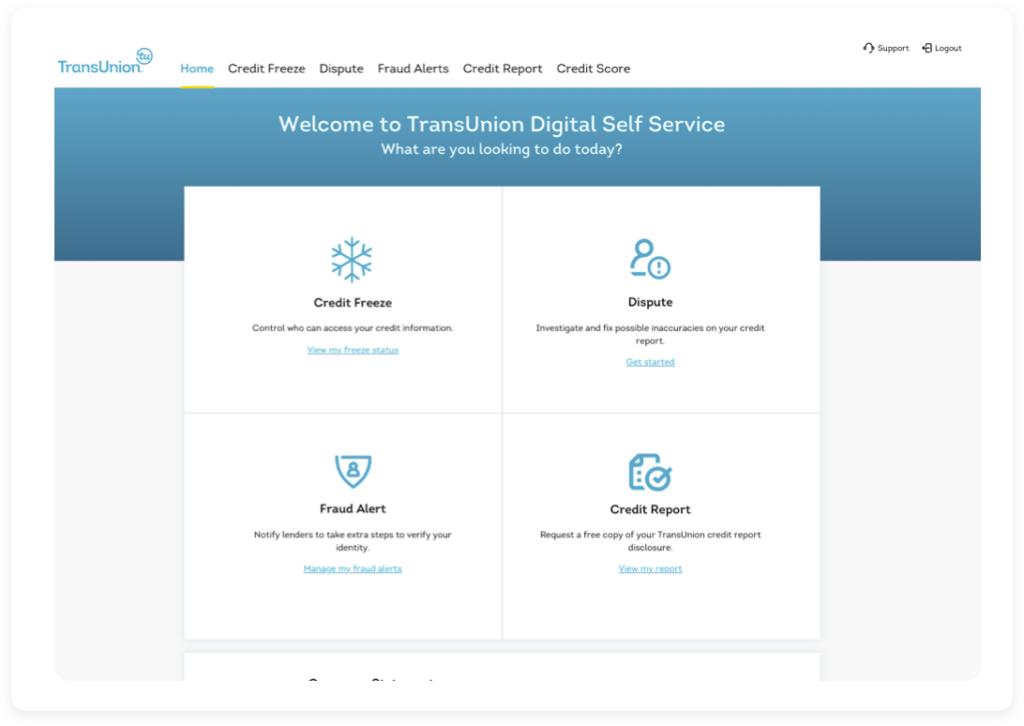

- Freeze your credit: Consider freezing your credit, which makes it more difficult for someone to open new accounts in your name.

- Check your credit report: Check your credit report regularly to make sure there are no unauthorized accounts or transactions.

Strong password practices are essential; using complex, unique passwords for different accounts and changing them regularly helps prevent unauthorized access. Employing password managers can facilitate this process by generating and storing strong passwords securely.

Two-factor authentication (2FA) adds an additional layer of security, requiring a second form of verification beyond just a password. This could be a text message code, an email, or an authentication app notification. Even if a password is compromised, 2FA makes it significantly harder for criminals to access your accounts.

Regularly updating software and devices ensures that the latest security patches are applied, closing vulnerabilities that could be exploited by hackers. This includes operating systems, applications, and antivirus software, which can detect and remove malicious programs from your devices.

Monitoring financial accounts and credit reports for unusual activity is crucial. Early detection of unauthorized transactions or accounts can be the key to minimizing damage. Freezing your credit with major credit bureaus prevents criminals from opening new accounts in your name, a critical step if you suspect you’ve been targeted.

Securing personal documents and sensitive information both online and offline is also vital. Shred documents containing personal information before disposal and limit what you carry in your wallet or purse. Be cautious about sharing personal information on social media and other public platforms, as criminals can use this information to bypass security questions or piece together your identity.

Educating yourself and your family members about phishing scams and other social engineering tactics can prevent the divulgence of sensitive information. Be skeptical of unsolicited requests for personal information, whether they come via email, phone calls, or text messages.

Using secure, encrypted connections for online transactions, especially on public Wi-Fi networks, can prevent eavesdroppers from intercepting your personal and financial information. Virtual private networks (VPNs) can provide a secure connection by encrypting data from your device to the internet.

Backing up important data protects you against ransomware attacks, which could otherwise lock you out of your personal files, demanding payment for their release. Regular backups to an external drive or cloud service ensure you can restore your information without caving to criminals’ demands.

What to do if You Suspect Criminal Identity Theft

If you suspect criminal identity theft, it’s essential to take immediate action to protect yourself and minimize the damage done by the thief. Here are the steps you should take:

- Place a Fraud Alert on your credit reports: Contact one of the three major credit bureaus (Equifax, Experian, or TransUnion) and request a fraud alert be placed on your credit reports. This will alert potential creditors that you may have been a victim of identity theft and they should take extra steps to verify your identity before granting credit.

- Review your credit reports: Review your credit reports from each of the three credit bureaus for any unauthorized accounts or transactions. You can request a free credit report from each bureau once per year at www.annualcreditreport.com.

- Contact the companies where fraudulent accounts were opened: Contact the companies where fraudulent accounts were opened and let them know that the account was opened fraudulently. Ask them to close the account and remove it from your credit report.

- File a report with law enforcement: File a report with your local police department or the Federal Trade Commission (FTC) to report the identity theft. You may also need to file a report with the police department where the crime occurred, if known.

- Contact an identity theft assistance service: Consider contacting an identity theft assistance service that can provide guidance and support in resolving the issue.

- Monitor your credit and accounts: Continue to monitor your credit reports and accounts for any suspicious activity.

- Consider freezing your credit: If you believe that your personal information has been compromised, you may want to consider freezing your credit to prevent new accounts from being opened in your name.

Start by placing a fraud alert on your credit reports by contacting one of the three major credit bureaus (Equifax, Experian, or TransUnion). This alert makes it harder for an identity thief to open more accounts in your name, as it requires companies to verify your identity before issuing credit. Next, obtain copies of your credit reports from all three bureaus to review for any discrepancies or unauthorized accounts.

Report the theft to the Federal Trade Commission (FTC) via their website or phone line. The FTC provides a recovery plan and an Identity Theft Report, an official statement to creditors that you’re a victim of identity theft. This report is instrumental in removing fraudulent accounts from your credit report.

Report Criminal Identity Theft

Report Your Criminal Identity Theft to the FTC at IdentityTheft.gov

Contact the fraud department of each company where you know an account was opened or charged fraudulently. Close these accounts, and follow up with letters, including a copy of your Identity Theft Report. Request written confirmation of the account closure and the fraudulent debts’ discharge.

File a report with your local police department. Provide them with as much evidence as possible, including your FTC Identity Theft Report, any other documentation you have of the theft, and proof of your identity. Request a copy of the police report; it can help you deal with creditors who need proof of the crime.

Change the passwords, logins, and PINs for all your accounts, especially if you use similar passwords across multiple sites. Consider using a password manager to generate and store complex passwords.

Monitor your credit reports and accounts regularly for signs of new fraudulent activity. It may be advisable to extend the initial fraud alert to a long-term fraud alert or a credit freeze, which prevents creditors from accessing your credit report entirely, making it much more difficult for an identity thief to open new accounts in your name.

Engage with a credit monitoring service if you are deeply concerned. These services keep a watchful eye on your credit report and alert you to any changes, allowing for quicker action against potential fraud.

Stay vigilant and educate yourself about the latest phishing scams and fraud tactics. Being informed can help you avoid future instances of identity theft and recognize the early signs of fraudulent activity.

If you find unauthorized transactions or accounts, dispute these with the credit bureaus and the creditors directly. Provide them with the necessary documentation and follow up until the issues are resolved.

Bottom Line

Criminal identity theft can have serious consequences, including falsely being accused of a crime. By taking steps to protect your personal information, you can reduce the risk of becoming a victim. Stay vigilant and proactive, and remember to report any suspicious activity immediately. With the right precautions, you can help prevent criminal identity theft and keep your personal information safe.

2025 Data Sources

- https://www.justice.gov/criminal/criminal-fraud/identity-theft/identity-theft-and-identity-fraud

- https://ovc.ojp.gov/sites/g/files/xyckuh226/

files/pubs/ID_theft/pfv.html - https://www.idtheftcenter.org/help_center/

clearing-your-name-from-criminal-identity-theft/ - https://www.ftc.gov/sites/default/files/

documents/public_comments/credit-report-freezes-534030-00033/534030-00033.pdf