Rocket Money, formerly known as Truebill, is one of the most popular consumer financial services developed in recent years. Rocket Money aims to help consumers save on monthly bills, fees, subscriptions, and other transactions by providing easy-to-understand visibility to its users. It surfaces hidden or unknown expenses that might typically fly under the radar or be hidden in the complexity of bank statements. It is also a great tool to help monitor transactions to ensure no fraudulent use of credit cards is occurring.

Due to the nature of this financial service, it has raised more than a few security and privacy concerns. We took an in-depth look into the Rocket Money service and its security measures to help consumers determine if Rocket Money is safe to use.

Rocket Money: Is It Safe to Use?

Yes, Rocket Money is safe to use. Rocket Money stores data using bank-level 256-bit encryption and its website has an active and verified SSL certificate.

Since the financial application developed and released by Rocket Money utilizes personal and financial records, it’s understandable to be skeptical. Although you may feel that when an app requires access to your files and financial records, it’s a red flag, you don’t have to be concerned about Rocket Money security.

The company itself knows what potential users have to say about the security risks that the service bears. When you look at the official Rocket Money website, you will notice a “Security” section found in the site footer.

As you conduct research, it becomes slightly easier to let go of any security concerns and worries that you have about Rocket Money by going through the company’s security disclosure:

- The company (i.e., Truebill/Rocket Money) connects with other financial institutions using the Plaid service

- The app offers 256-bit encryption protection features for users’ data

- The company claims that it doesn’t sell users’ private data to the highest bidders

- The company claims to store users’ data on Amazon Web Services (i.e., ideally, where the US Department of Defense stores sensitive data)

- Due to Plaid service, Rocket Money doesn’t require banking credentials from you or other users

Ultimately, you’re the sole judge of whether you should trust Rocket Money with your data, including personal information and financial records.

Overall, we would say that Rocket Money is trustworthy and safe to use.

Better Business Bureau (BBB) Rating

The Better Business Bureau has accredited and reviewed Truebill with a “B” rating. Although the overall 5-star scale rating was lower for Truebill (currently sitting at 3.25/5 stars), the company did receive positive feedback from BBB.

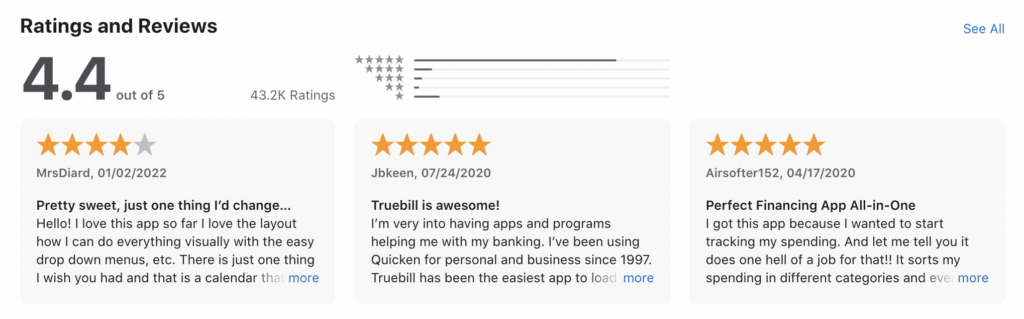

Apple App Store and Google Play Ratings

Truebill has a 4.4-star rating from 43 thousand reviews on the Apple App Store.

It also has a 4.3-star rating from 32 thousand reviews on the Google Play Store.

These are very high ratings considering the total number of user reviews. These data points all help to solidify the security, safety, and legitimacy of Truebill (Rocket Money).

The Legitimacy of Rocket Money: What to Know

Rocket Money is a legitimate company that follows current security and storage standards. The company was founded in 2015 and raised a total of $84 million dollars in funding. In 2021, the publicly traded company Rocket Companies acquired Truebill, further legitimizing them. They utilize bank-level 256-bit encryption to protect your data. They also host their servers via AWS (Amazon Web Services) which is one of the most popular and secure forms of cloud hosting. They also leverage Plaid, which is one of the safest and most commonly used ways to connect to your bank.

Conclusion

If you are looking to save on monthly bills and better monitor your bank statements, Rocket Money could be a great solution for you. Rocket Money has helped millions of users keep track of their finances and save money on everyday expenses. Truebill is safe to use and we recommend trying the service out. If you feel that Rocket Money isn’t right for you, it can be easily canceled.