LifeLock

Best for Comprehensive Credit Monitoring

- Stolen fund reimbursement

- Dark web monitoring

- Data breach monitoring

Aura

Best Identity Theft Restoration Offering

- $1 million in coverage

- Live alerts

- Easy mobile app

Identity Guard

Best for AI-Powered Monitoring

- Advanced AI monitoring

- J.D Power winner

- Customizable plans

Identity theft is a growing concern, affecting millions of people every year. Cybercriminals use stolen personal information to open fraudulent accounts, drain bank accounts, and even commit crimes in your name. The best identity theft protection services help monitor your personal data, alert you to potential threats, and assist with recovery if your identity is compromised.

We’ve tested and reviewed the best identity theft protection services to help you find the right solution to safeguard your personal and financial information.

List of the Best Identity Theft Protection Companies

- LifeLock – Best for Comprehensive Credit Monitoring

- Aura – Best Identity Theft Restoration Offering

- Identity Guard – Best for AI-Powered Monitoring

- IdentityForce – Best for Families

- Experian IdentityWorks – Best for Credit-Focused Protection

- IDShield – Best for Legal Assistance

The Best ID Theft Protection Services

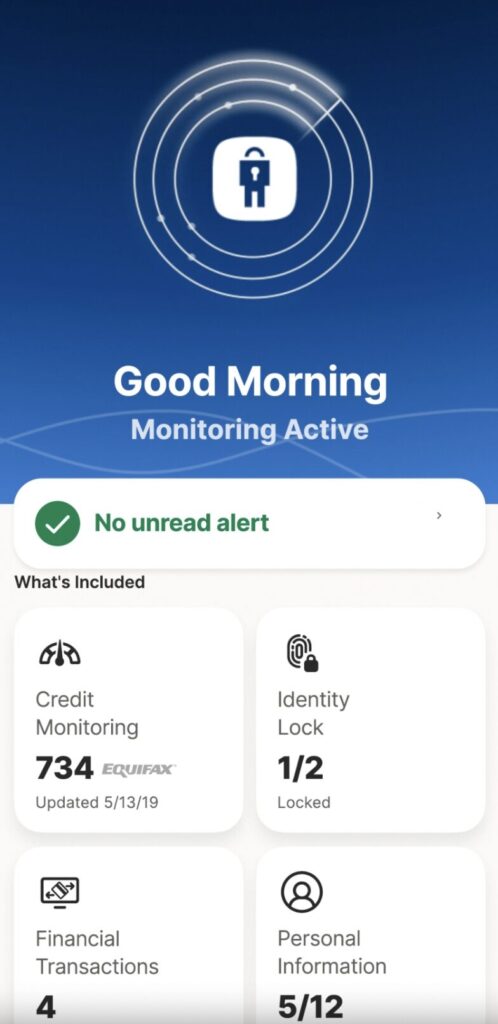

LifeLock – Best for Comprehensive Credit Monitoring

LifeLock is our top pick for the best identity theft protection service due to its comprehensive monitoring, advanced security features, and ease of use. It offers a wide range of protections, including identity and Social Security number monitoring, credit tracking, bank and investment account alerts, and stolen funds reimbursement. The service also provides data breach notifications, dark web monitoring, home title monitoring, and social media scanning on higher-tier plans. Customers benefit from 24/7 U.S.-based identity restoration support, ensuring that any identity theft incidents are handled quickly and effectively.

LifeLock’s pricing is divided into three main tiers. The Standard plan costs $7.50 per month for the first year and renews at $11.99 per month, offering basic SSN and credit monitoring. The Advantage plan starts at $14.99 per month for the first year and renews at $22.99 per month, adding features like bank account alerts and phone takeover monitoring. The highest-tier plan, Ultimate Plus, costs $19.99 per month initially and renews at $34.99 per month, providing three-bureau credit monitoring, 401(k) and investment account tracking, and home title monitoring.

Security and reliability are key strengths of LifeLock, as it is backed by Norton, a leading cybersecurity company. It offers strong encryption, real-time alerts via mobile, email, or text, and expert fraud resolution support. The service is compatible with Windows, Mac, iOS, and Android, with a user-friendly interface that makes managing alerts and reports simple. It also integrates well with Norton 360, providing additional cybersecurity features such as antivirus protection, VPN access, and dark web monitoring.

LifeLock has several advantages, including comprehensive identity monitoring, a $1 million identity theft insurance policy for legal fees, and an intuitive mobile app. It also offers family plans for added protection. However, there are some drawbacks, such as higher renewal prices after the first year and the fact that certain features, like three-bureau credit monitoring, are only available with the most expensive plan. VPN and antivirus protection are included only with Norton 360 bundles.

LifeLock stands out as a top-tier identity theft protection service due to its robust monitoring capabilities, strong cybersecurity backing, and ease of use. While it may be more expensive than some competitors, its extensive protections and insurance coverage make it a valuable investment for those looking to safeguard their personal and financial information.

Pros

- Comprehensive Monitoring – Includes SSN, credit, bank accounts, home title, and dark web monitoring.

- $1 Million Identity Theft Insurance – Covers legal and expert fees for identity theft resolution.

- Real-Time Alerts – Notifies users via mobile, email, or text when suspicious activity is detected.

- 24/7 U.S.-Based Customer Support – Provides expert assistance for fraud resolution.

- User-Friendly Mobile App – Easy-to-navigate interface for managing alerts and reports.

- Integration with Norton 360 – Offers additional cybersecurity features like a VPN, antivirus, and secure browsing.

- Family Plans Available – Allows multiple users to be protected under a single subscription.

- Strong Security Measures – Uses 256-bit encryption and dark web surveillance to keep personal data safe.

Cons

- Higher Renewal Prices – First-year discounts are substantial, but renewal rates increase significantly.

- Limited Features on Lower Plans – Three-bureau credit monitoring, 401(k) protection, and home title monitoring are only available on the Ultimate Plus plan.

- No Free Plan or Trial – Unlike some competitors, LifeLock does not offer a free version or trial period.

- VPN and Antivirus Require Norton 360 Bundle – These cybersecurity features are not included in standard LifeLock plans.

- Potential Overlap with Bank & Credit Card Monitoring – Some financial institutions offer similar fraud alerts for free.

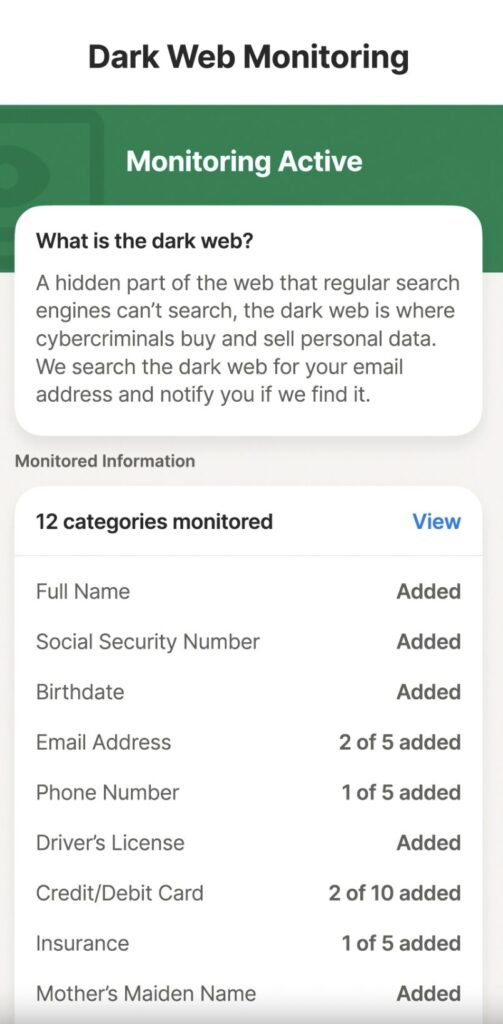

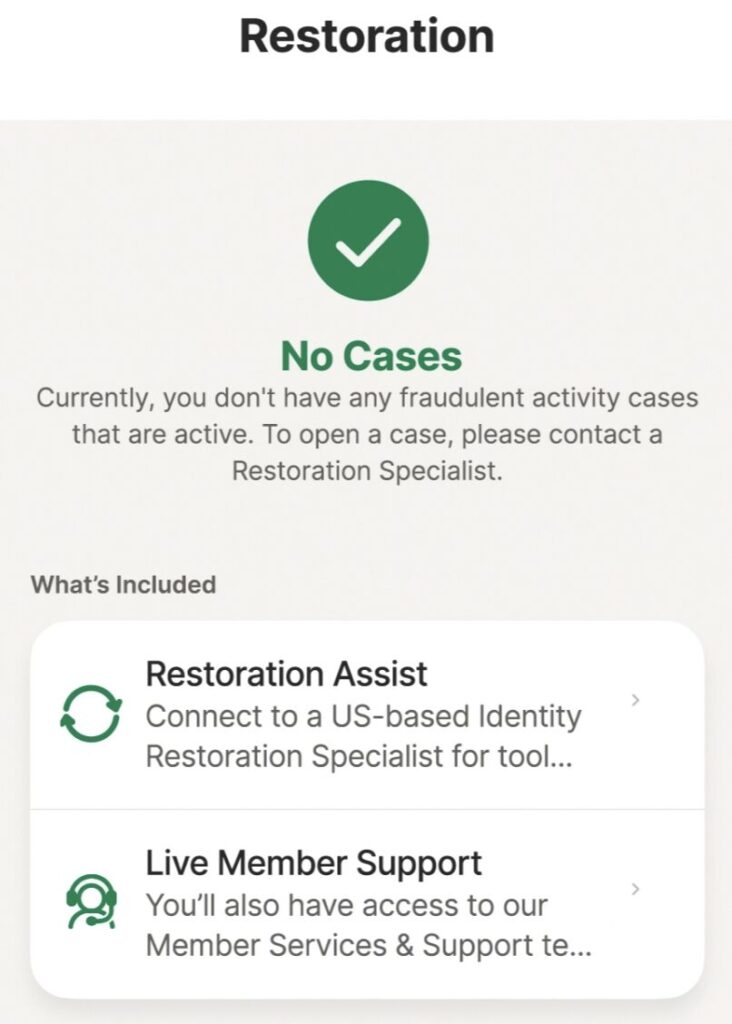

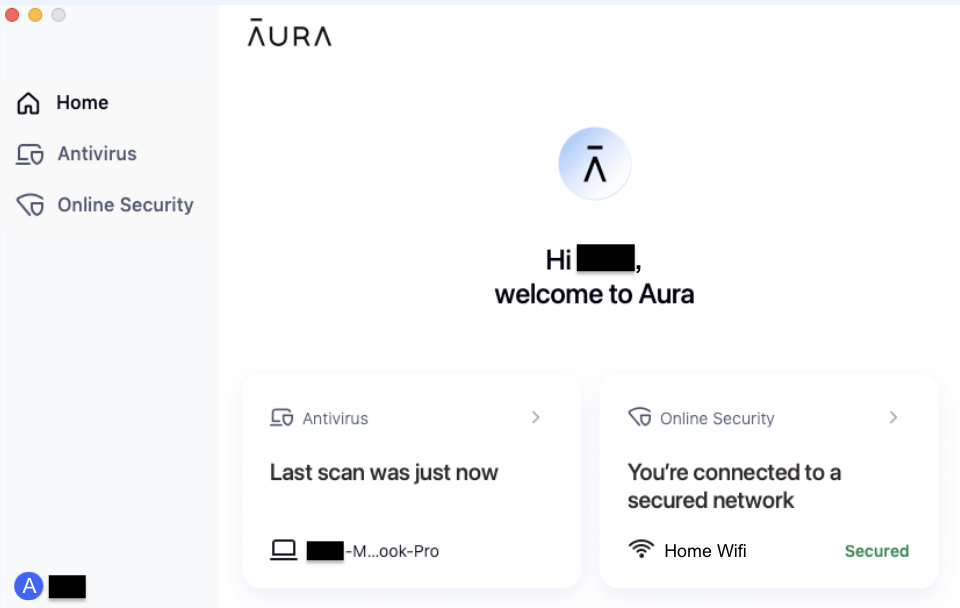

Aura – Best Real-Time Alerts

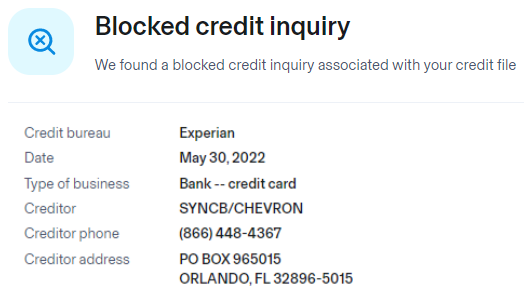

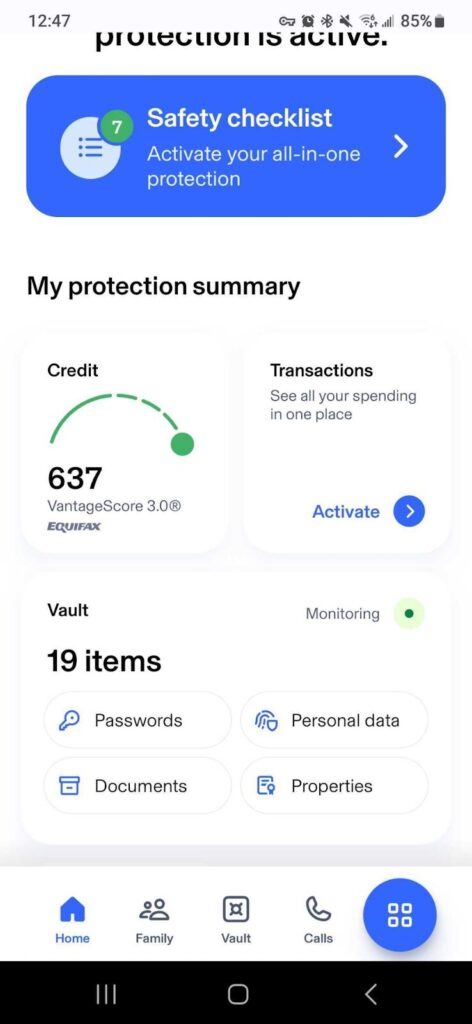

Aura is our #2 pick for the best identity theft protection service due to its comprehensive features, strong security measures, and ease of use. It provides continuous identity and credit monitoring, keeping track of Social Security numbers, bank accounts, and credit reports from all three major bureaus. Also, it monitors financial accounts for unusual transactions and alerts users of potential fraud.

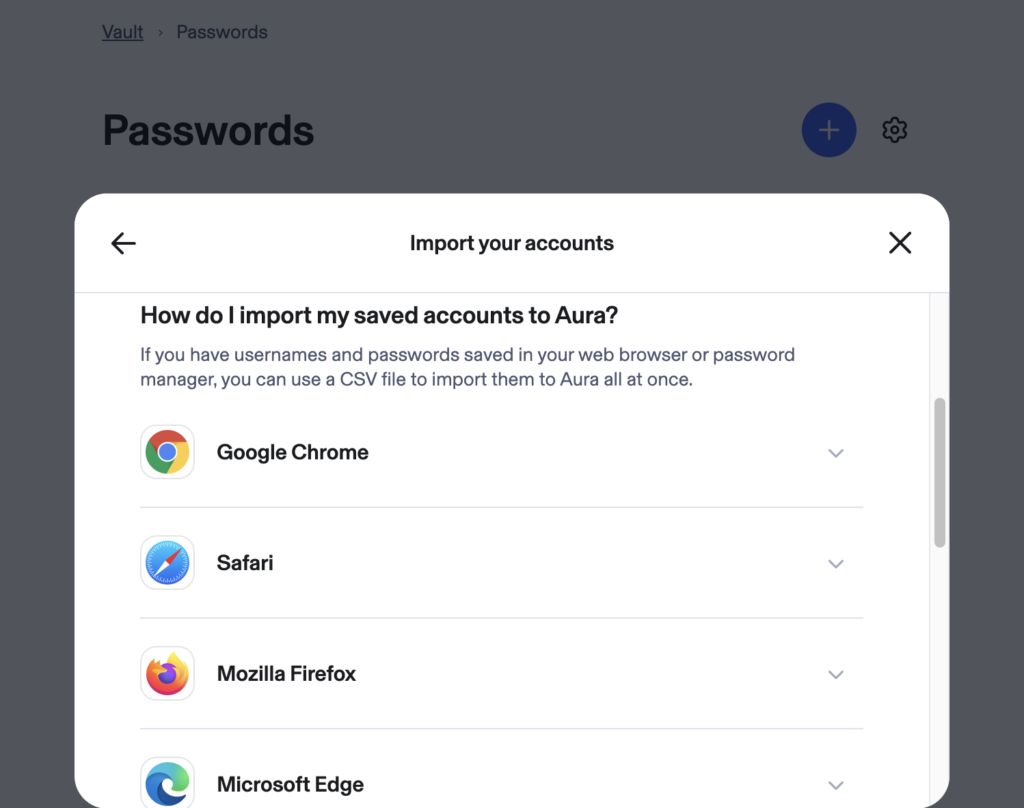

Beyond identity protection, Aura includes digital security tools such as antivirus software, a virtual private network (VPN), a password manager, and Safe Browsing tools to safeguard online activities. For families, it offers parental controls, content filters, screen time limits, and Safe Gaming alerts to create a secure online environment for children.

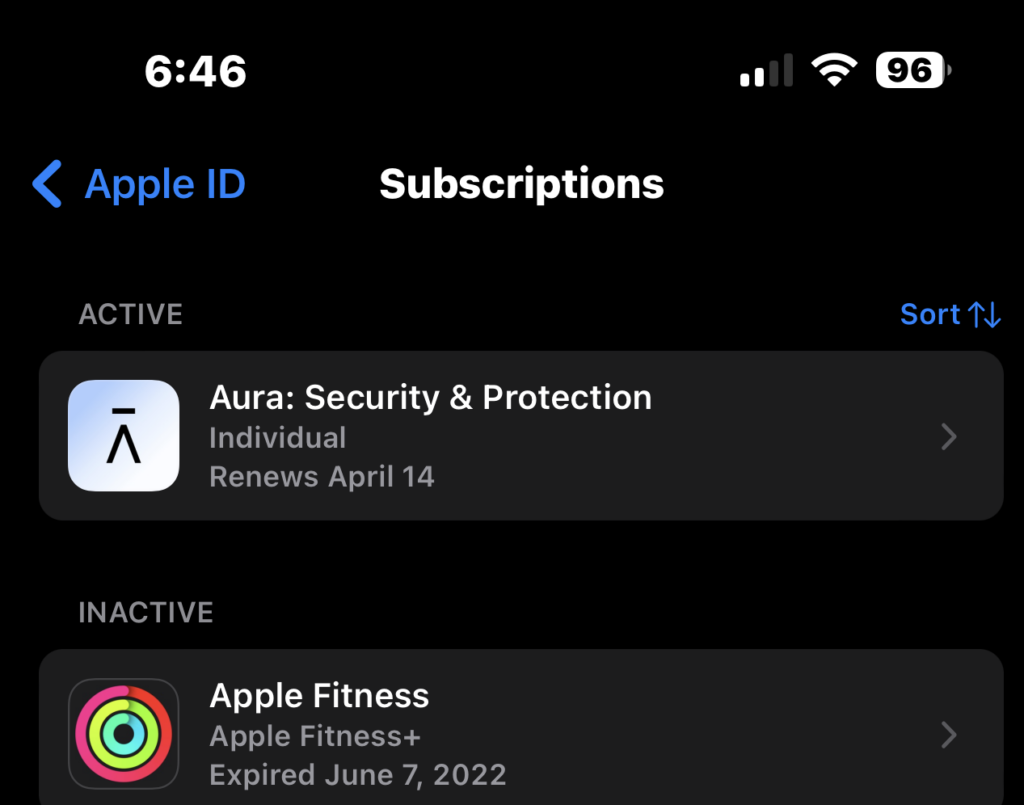

Aura’s pricing is straightforward, with an Individual Plan costing $12 per month when billed annually, a Couple Plan at $22 per month, and a Family Plan at $32 per month. Each adult member receives up to $1 million in identity theft insurance, with family plans covering up to five adults and unlimited children.

Security is a major focus for Aura, as it provides three-bureau credit monitoring across all plans. Digital security tools come included in every plan, offering protection beyond identity theft. The company also provides identity theft insurance coverage of up to $1 million per adult, ensuring financial security in case of fraud.

The platform is highly compatible, available on iOS, Android, desktops, and major browsers. Its user-friendly dashboard simplifies navigation and account management. Family plans allow each adult to have their own account and dashboard, ensuring privacy and convenience for multiple users.

Aura’s combination of identity monitoring, financial protection, digital security tools, competitive pricing, and ease of use makes it one of the top choices for identity theft protection today.

Pros

- Comprehensive Identity Protection: Monitors Social Security numbers, bank accounts, credit reports, and financial transactions.

- Three-Bureau Credit Monitoring: Provides alerts from Experian, Equifax, and TransUnion.

- Digital Security Tools Included: Comes with antivirus software, VPN, password manager, and Safe Browsing features.

- $1 Million Identity Theft Insurance: Covers financial losses per adult (up to $5 million for family plans).

- User-Friendly Interface: Easy-to-use dashboard available on mobile and desktop.

- Family-Friendly Plans: Covers up to five adults and unlimited children, with individual dashboards for privacy.

- Parental Controls and Safe Gaming: Protects children online with content filtering and activity monitoring.

- Real-Time Alerts: Faster fraud detection compared to some competitors.

- 24/7 U.S.-Based Customer Support: Access to live identity theft resolution specialists.

Cons

- Higher Cost Than Some Competitors: Plans start at $12/month for individuals and $32/month for families, which may be pricier than basic competitors.

- No Free Plan or Trial: Unlike some other services, Aura does not offer a free version or trial period.

- VPN and Antivirus May Not Replace Dedicated Solutions: While useful, the included security tools may not be as robust as standalone cybersecurity products.

Identity Guard – Best for AI-Powered Monitoring

Identity Guard breaks into the 3rd spot on our list of the best identity theft protection services due to its robust security features, AI-driven monitoring, and comprehensive coverage. It offers a combination of advanced tools, affordability, and ease of use, making it an excellent choice for individuals and families looking to safeguard their personal and financial information.

One of the key aspects of Identity Guard is its use of IBM Watson artificial intelligence to monitor and analyze threats in real-time. This AI technology scans billions of data points across the dark web, financial accounts, and other sources to detect potential breaches before they escalate into serious fraud. It provides alerts for various risks, including data breaches, credit report changes, and personal information exposure.

Identity Guard offers different plans tailored to varying levels of protection and budget needs. The most affordable plan, Value, provides basic identity monitoring and alerts, while the Total and Ultra plans offer more extensive features, such as dark web monitoring, social security number tracking, and credit bureau reports. The Ultra plan includes the most comprehensive coverage, with monthly credit score updates, financial account monitoring, and criminal record tracking.

In terms of security, Identity Guard provides encrypted storage for sensitive documents and offers a secure online dashboard where users can access alerts and reports. The service also includes risk management tools that educate users on how to prevent identity theft and respond effectively in case of an incident.

Compatibility is another strong point for Identity Guard. It can be accessed from both desktop and mobile devices, making it easy for users to monitor their identity on the go. The mobile app is user-friendly and allows quick access to alerts, reports, and support.

Ease of use is a major advantage of Identity Guard, as the platform is designed with simplicity in mind. Setting up an account is straightforward, and the dashboard presents important alerts and reports in a clear, organized manner. Customer support is available for assistance, and users benefit from insurance coverage for identity theft losses, which can go up to $1 million, depending on the plan.

Overall, Identity Guard stands out due to its AI-driven monitoring, flexible pricing plans, strong security measures, cross-platform compatibility, and user-friendly interface. These features make it one of the most reliable options for individuals and families looking to protect themselves from identity theft.

IdentityForce – Best for Families

IdentityForce is widely regarded as one of the best identity theft protection services due to its comprehensive security features, user-friendly experience, and strong reputation for protecting personal and financial data. It offers extensive monitoring, real-time alerts, and insurance coverage, making it a reliable choice for individuals and families looking to safeguard their identity.

One of the key strengths of IdentityForce is its robust monitoring system, which includes tracking for Social Security numbers, bank and credit card activity, address changes, and even dark web surveillance. It provides real-time alerts whenever suspicious activity is detected, allowing users to act quickly in case of potential fraud. Also, it offers medical ID fraud protection, a feature not commonly found in all identity theft protection services.

Security is a top priority for IdentityForce, as it employs bank-level encryption to protect user data and prevent unauthorized access. It also includes two-factor authentication and secure login features to add extra layers of protection. The service is compatible with both desktop and mobile platforms, offering a seamless experience across devices through an intuitive dashboard and a mobile app that ensures users can monitor their information on the go.

IdentityForce also provides identity restoration services, which include expert assistance in recovering stolen identities and resolving fraudulent activities. In the event of identity theft, users have access to up to $1 million in identity theft insurance to cover financial losses and legal expenses. The service includes credit monitoring with reports from major bureaus, and premium plans offer credit score tracking to help users maintain financial health.

Pricing for IdentityForce varies based on the level of protection chosen. The UltraSecure plan focuses on identity theft monitoring and restoration, while the UltraSecure+Credit plan includes additional credit monitoring and reporting services. While it is not the cheapest service on the market, the comprehensive nature of its features and customer support justifies the cost for those looking for top-tier protection.

Ease of use is another major advantage of IdentityForce. The platform is designed to be intuitive, with a well-organized dashboard that allows users to review alerts, monitor financial accounts, and access customer support effortlessly. The mobile app extends these features to ensure accessibility and convenience, making it an excellent choice for those who need real-time monitoring and protection.

IdentityForce stands out as a leading identity theft protection service due to its advanced security measures, extensive monitoring capabilities, strong financial protection, and user-friendly experience. It is particularly well-suited for individuals and families who prioritize comprehensive identity theft prevention and recovery support.

Experian IdentityWorks – Best for Credit-Focused Protection

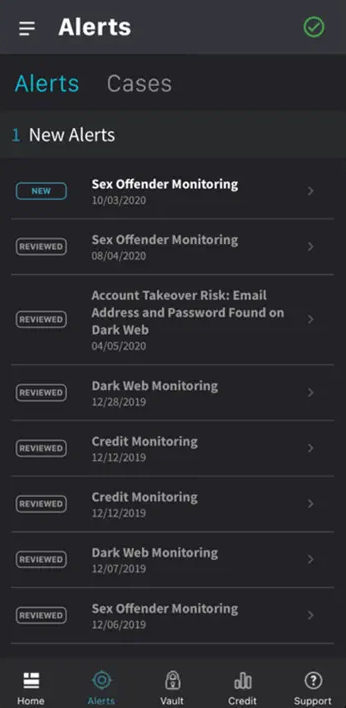

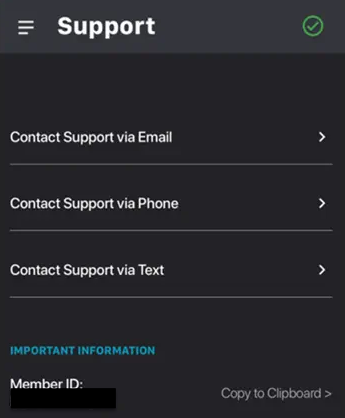

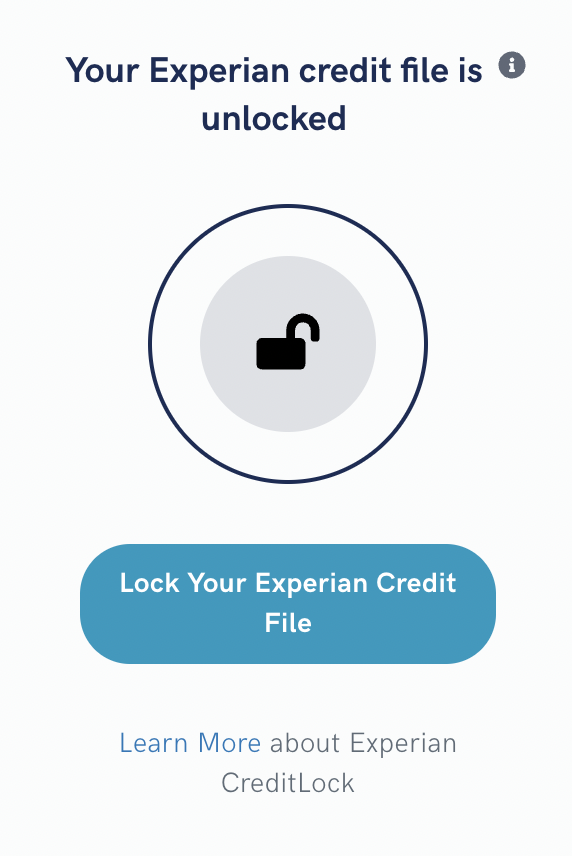

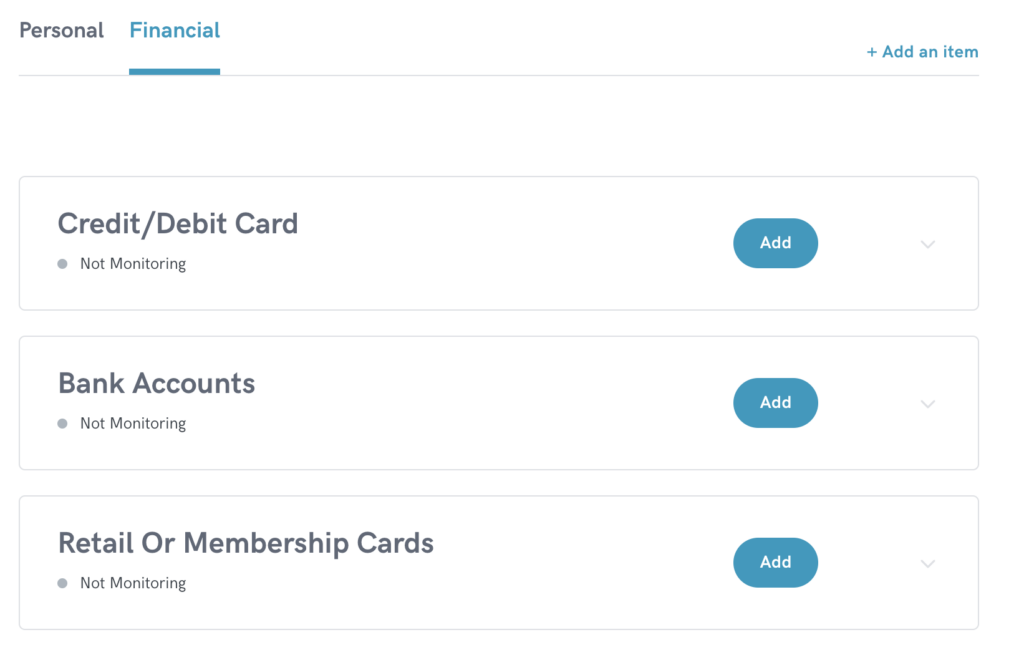

Experian IdentityWorks is considered one of the best identity theft protection services due to its comprehensive monitoring, strong security features, and user-friendly interface. It offers various identity protection tools, including credit monitoring, dark web surveillance, and identity theft insurance, making it a reliable choice for individuals looking to safeguard their personal information.

One of its standout features is credit monitoring from all three major credit bureaus—Experian, Equifax, and TransUnion. This allows users to track their credit activity across multiple platforms and receive alerts about any suspicious changes. In addition, Experian IdentityWorks provides real-time fraud alerts and a FICO® Score tracker, which helps users stay on top of their credit health.

The service also includes dark web monitoring, scanning for personal information such as Social Security numbers, credit card details, and email addresses on illicit marketplaces and hacker forums. If compromised data is detected, users are promptly notified, allowing them to take immediate action. Another key feature is financial account takeover monitoring, which alerts users to unauthorized changes in their bank and investment accounts.

Experian IdentityWorks offers identity theft insurance coverage of up to $1 million, providing financial assistance for legal fees and lost wages in case of fraud. It also includes identity restoration services, with dedicated fraud resolution specialists available to help users recover from identity theft incidents.

In terms of cost, IdentityWorks offers both a free basic version and premium plans with more extensive features. The paid plans typically range from around $9.99 to $29.99 per month, depending on the level of protection selected. The higher-tier plans include family options, allowing coverage for children’s identities as well.

Security is a top priority, with robust encryption protocols and multi-factor authentication ensuring users’ sensitive information remains protected. The service is compatible with both desktop and mobile devices, making it convenient for users to access their accounts and receive alerts on the go.

Experian IdentityWorks is designed for ease of use, featuring an intuitive dashboard that provides a clear overview of credit status, alerts, and risk factors. The setup process is straightforward, with step-by-step guidance for activating monitoring services and linking financial accounts.

Experian IdentityWorks stands out due to its extensive credit and identity monitoring, strong security features, and responsive customer support, making it a top choice for individuals looking for reliable identity theft protection.

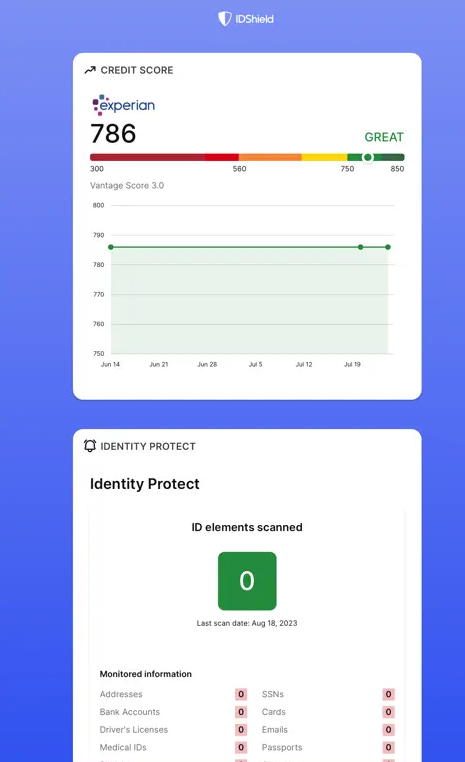

IDShield – Best for Legal Assistance

IDShield is recognized as a leading identity theft protection service due to its comprehensive features, affordability, and user-friendly design. It offers extensive monitoring of personal information, including Social Security numbers, dark web surveillance, and social media accounts, providing real-time alerts for any suspicious activities. In the event of identity theft, IDShield provides full restoration services with licensed private investigators dedicated to restoring your identity to its pre-theft status.

The service includes financial protection through continuous credit monitoring, monthly credit score tracking, and alerts for potential threats. Additionally, IDShield offers cybersecurity tools such as a password manager to safeguard your online presence.

IDShield’s pricing is competitive, with individual plans starting at $14.95 per month for single-bureau credit monitoring and $19.95 per month for three-bureau monitoring. Family plans, covering up to two adults and 10 children, are available at $29.95 per month for single-bureau and $34.95 per month for three-bureau monitoring. All plans come with up to $3 million in identity theft insurance coverage.

The platform is designed for ease of use, featuring an intuitive dashboard that allows users to monitor alerts and manage their protection services efficiently. IDShield is compatible with various devices, including Windows, macOS, Android, and iOS, ensuring accessibility across multiple platforms.

IDShield’s robust monitoring capabilities, dedicated restoration services, comprehensive cybersecurity tools, and affordable pricing make it a top choice for individuals and families seeking reliable identity theft protection.

Additional Identity Theft Protection Services

The following are additional offerings that did not make our list of the best identity theft protection services.

- ID Watchdog

- PrivacyGuard

- Zander

- myFICO

What is Identity Theft Protection?

Identity theft protection services can include:

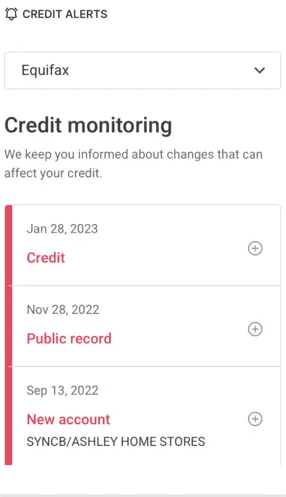

- Credit monitoring: This involves monitoring your credit reports for any suspicious activity, such as new accounts being opened in your name or unauthorized changes to your existing accounts.

- Fraud detection: This can include monitoring your financial accounts for suspicious transactions or unauthorized withdrawals.

- Identity restoration: This service helps individuals recover from identity theft by providing them with assistance in contacting credit bureaus, financial institutions, and other parties that may need to be notified of the identity theft.

- Public record monitoring: This can help to identify any suspicious changes to your personal information, such as your address or phone number, that may have been made by someone trying to steal your identity.

Identity theft protection services can be offered by companies, financial institutions, or credit bureaus. Some identity theft protection services are free, while others require a subscription fee. It’s important to understand the terms of service and cost of a protection service before subscribing, and also to be aware that no identity protection service can fully guarantee the protection of one’s identity.

What are the Benefits of Identity Theft Protection Services?

Identity theft protection services offer a range of benefits that can help protect individuals from the damaging effects of identity theft. Some of the main benefits of these services include:

- Early detection: Identity theft protection services monitor credit reports, bank accounts, and other financial activities to detect any suspicious activity early. This can help prevent or minimize the damage caused by identity theft.

- Resolution assistance: In the unfortunate event that someone’s identity is stolen, identity theft protection services can provide assistance with the resolution process. This can include help with contacting financial institutions, credit bureaus, and law enforcement agencies, as well as providing guidance on how to restore credit and identity.

- Insurance coverage: Many identity theft protection services offer insurance coverage that can reimburse victims for any financial losses incurred as a result of identity theft. This can provide peace of mind knowing that there is financial protection in place in the event of identity theft. The most common amount of coverage is up to $1 million.

- Education and resources: Identity theft protection services often provide educational resources and tools to help individuals learn more about identity theft and how to prevent it. This can include tips for securing personal information and protecting against phishing scams.

The best identity theft protection services can provide valuable protection and peace of mind for individuals concerned about the threat of identity theft.

How Can You Protect Your Identity for Free?

While identity theft protection services can provide added security, there are also steps that individuals can take to protect their identity for free:

- Check your credit reports: You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Reviewing these reports regularly can help you identify any suspicious activity, such as new accounts opened in your name or unauthorized changes to your existing accounts.

- Use strong and unique passwords: Use strong and unique passwords for all of your online accounts and avoid using the same password for multiple accounts. A strong password should be at least 12 characters long and include a combination of letters, numbers, and special characters. You can also utilize a password manager to securely store these passwords.

- Be cautious with personal information: Avoid sharing personal information online or over the phone, and be wary of unsolicited calls or emails asking for personal information.

- Use security software: Keep your computer and mobile devices protected with up-to-date antivirus and anti-malware software.

- Monitor your financial accounts: Regularly check your bank and credit card statements for any suspicious transactions or unauthorized withdrawals.

- Secure your mail and trash: Use a locking mailbox or a mail slot to prevent mail theft, and shred sensitive documents before throwing them away.

- Be cautious when using public Wi-Fi: Public Wi-Fi networks can be vulnerable to hackers, so avoid accessing sensitive information or financial accounts when using public Wi-Fi.

- Use privacy settings: Use privacy settings on social media platforms and be selective about the information you share.

It’s worth noting that even if you take all the necessary precautions, there is still a chance that your identity can be stolen. The best defense is to stay vigilant and monitor your credit reports, bank and credit card statements, and any other important personal information regularly.

James (J.T.) Moore

Systems Engineer and Lead Analyst